Financial Year - GMM Pfaudler Ltd

Financial Year - GMM Pfaudler Ltd

Financial Year - GMM Pfaudler Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

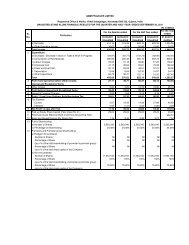

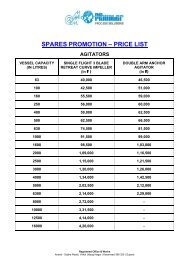

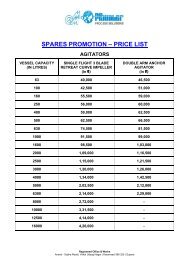

SCHEDULE 17: NOTES FORMING PART OF THE ACCOUNTS1. BACKGROUND<strong>GMM</strong> <strong>Pfaudler</strong> Limited, formerly Gujarat Machinery Manufacturers Limited, (“the Company”) was incorporated in India on November17, 1962. The Company’s manufacturing unit is located at Karamsad, Gujarat. The Company’s principal activity is the manufactureof corrosion resistant glass-lined equipment used primarily in the chemical, pharmaceutical and allied industries. The Company alsomanufactures flouro-polymer products and other chemical process equipment such as agitated nutsche filters, filter driers, wipedfilm evaporators and mixing systems.The Company has entered into an investment and technical know-how agreement with <strong>Pfaudler</strong> Inc. USA (‘<strong>Pfaudler</strong>’) a Companyincorporated in the United States of America, which owns 51 percent of the total issued share capital of the Company. The Company’sultimate holding Company is Robbins & Myers Inc, USA.2. SIGNIFICANT ACCOUNTING POLICIESa) Accounting conventionThe financial statements are prepared under the historical cost convention using the accrual method of accounting, inaccordance with generally accepted accounting principles in India, the Accounting Standards prescribed in the Companies(Accounting Standards) Rules, 2006 and the provisions of the Companies Act, 1956.b) Use of EstimatesThe preparation of financial statements in conformity with Generally Accepted Accounting Principles requires the managementto make estimates and assumptions that affect the reported balances of assets and liabilities as of the date of the financialstatements and reported amounts of income and expense during the period. Management believes that the estimates used inpreparation of financial statements are prudent and reasonable. Actual results could differ from the estimates.c) Fixed assets and depreciationFixed assets are stated at cost less accumulated depreciation. Cost includes all expenses related to the acquisition andinstallation of fixed assets.Assets acquired under finance lease are capitalized at the lower of the fair value of the leased assets and the present value ofthe minimum lease payments as at the inception of the lease.Depreciation is provided pro rata to the period of use, on the straight line method at the rates specified in Schedule XIV to theCompanies Act, 1956.Leasehold land and lease improvements are amortised equally over the period of lease.d) Asset ImpairmentThe Company reviews the carrying values of tangible and intangible assets for any possible impairment at each balance sheetdate. An impairment loss is recognized when the carrying amount of an asset exceeds its recoverable amount. In assessingthe recoverable amount, the estimated future cash flows are discounted to their present value based on appropriate discountrates.e) Investments(i)(ii)Investments are classified into long term and current investments.Long-term investments including strategic investments are carried at cost. Provision for diminution, if any, in the value ofeach long-term investment is made to recognise a decline, other than of a temporary nature.(iii) Current investments are stated at lower of cost and fair value and the resultant decline, if any, is charged to revenue.f) InventoriesInventories are stated at lower of cost and net realizable value. Cost is determined on the weighted average method and isnet of CENVAT credits. Cost of work-in-progress and finished goods includes conversion cost and appropriate productionoverheads. Excise duty is provided on finished goods held in stock at the end of the year.29