PER<strong>FOR</strong>MANCE ANDFINANCIAL INDICATORSEnergy for life<strong>ENERGY</strong> <strong>FOR</strong> <strong>PEOPLE</strong>EBITDA represents earnings beforeinterest, income tax, depreciation andamortization. EBITDA is a supplementalnon-GAAP financial measure usedby management, as well as industryanalysts, to evaluate operations.Management believes that EBITDArepresents useful means of assessingthe performance of the Company’songoing operating activities, as itreflects the Company’s earningstrends without showing the impact ofcertain charges. EBITDA is not usedby management as an alternativeto net income as an indicator of theCompany’s operating performance,as an alternative to any other measureof performance in conformity with USGAAP or as an alternative to cash flowfrom operating activities as a measureof liquidity. EBITDA does not havea standardized meaning prescribed byUS GAAP.Liquidity and Capital ResourcesCASH FLOWSChange %(in US$ million) 2009 2008 2007 2009-2008 2008-2007Net cash provided by operating activities 3,474 5,483 5,316 (36.6) 3.1Net cash used in investing activities (4,879) (3,502) (5 636) 39.3 (37.9)Net cash provided by (used in) financing activities185 (566) (320) (132.7) 76.9NET CASH PROVIDED BY OPERATINGACTIVITIESIn 2009 net cash provided by operatingactivities was US$ 3,474 million ascompared to US$ 5,483 million in thesame period of 2008. The decrease ofUS$ 2,009 million or 36.6% in net cashprovided by operating activities is dueto the following:AAa decrease in income before tax ofUS$ 2,264 million;AAan increase in working capital of US$399 million;AAa decrease in income taxes of US$648 million.In 2008 net cash provided by operatingactivities was US$ 5,483 million ascompared to US$ 5,316 million in thesame period of 2007. The increase ofUS$ 167 million or 3.1% in net cashprovided by operating activities is dueto the following:AAan increase in income before taxof US$ 703 million;AAan increase in working capital ofUS$ 977 million;AAan increase in income taxes ofUS$ 149 million.NET CASH USED IN INVESTINGACTIVITIESIn 2009 net cash used in investingactivities was US$ 4,879 millioncompared to US$ 3,502 million in 2008(39.3% increase). The increase of US$1,377 million in the net cash used ininvesting activities was mainly due tothe Company’ acquisitions of NIS andSibir during 2009.In 2008 net cash used in investingactivities was US$ 3,502 millioncompared to US$ 5,636 million in 2007(or 37.9% decrease). These changesin the net cash used in investingactivities were due to acquisition of50% interest in Tomskneft in December2007 and due to an increase of capitalexpenditures by US$ 1,154 million in2008 compared to 2007, which wasdue to the necessity to maintain theCompany’s production on existingfields and development of the relatedinfrastructure.Net Cash Provided by (Used in)Financing ActivitiesIn 2009 net cash provided by financingactivities was US$ 185 million ascompared to US$ 566 million of cashused in financing activities for the sameperiod of 2008. An increase was mainlydue to increase in net loans proceedsover repayments by US$ 851 million,which was partially offset by an increasein dividend payments of US$ 145 millionin 2009 compared to the same periodof 2008.In 2008 net cash used in financingactivities was US$ 566 million ascompared to US$ 320 million of netcash used in financing activities for thesame period of 2007. The increase ofUS$ 246 million or 76.9% was due tonet loans repayments over proceeds byUS$ 1,480 million, which was partiallyoffset by a decrease in dividendpayments of US$ 1,279 million in 2008compared to the same period of 2007.84

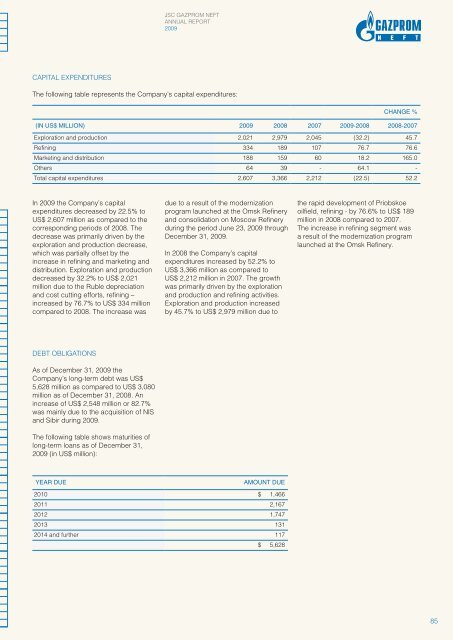

<strong>JSC</strong> GAZPROM NEFTANNUAL REPORT2009CAPITAL EXPENDITURESThe following table represents the Company’s capital expenditures:Change %(in US$ million) 2009 2008 2007 2009-2008 2008-2007Exploration and production 2,021 2,979 2,045 (32.2) 45.7Refining 334 189 107 76.7 76.6Marketing and distribution 188 159 60 18.2 165.0Others 64 39 - 64.1 -Total capital expenditures 2,607 3,366 2,212 (22.5) 52.2In 2009 the Company’s capitalexpenditures decreased by 22.5% toUS$ 2,607 million as compared to thecorresponding periods of 2008. Thedecrease was primarily driven by theexploration and production decrease,which was partially offset by theincrease in refining and marketing anddistribution. Exploration and productiondecreased by 32.2% to US$ 2,021million due to the Ruble depreciationand cost cutting efforts, refining –increased by 76.7% to US$ 334 millioncompared to 2008. The increase wasdue to a result of the modernizationprogram launched at the Omsk Refineryand consolidation on Moscow Refineryduring the period June 23, 2009 throughDecember 31, 2009.In 2008 the Company’s capitalexpenditures increased by 52.2% toUS$ 3,366 million as compared toUS$ 2,212 million in 2007. The growthwas primarily driven by the explorationand production and refining activities.Exploration and production increasedby 45.7% to US$ 2,979 million due tothe rapid development of Priobskoeoilfield, refining - by 76.6% to US$ 189million in 2008 compared to 2007.The increase in refining segment wasa result of the modernization programlaunched at the Omsk Refinery.DEBT OBLIGATIONSAs of December 31, 2009 theCompany’s long-term debt was US$5,628 million as compared to US$ 3,080million as of December 31, 2008. Anincrease of US$ 2,548 million or 82.7%was mainly due to the acquisition of NISand Sibir during 2009.The following table shows maturities oflong-term loans as of December 31,2009 (in US$ million):Year dueAmount due2010 $ 1,4662011 2,1672012 1,7472013 1312014 and further 117$ 5,62885