2001-02 Annual Report - Sydney Local Health District - NSW ...

2001-02 Annual Report - Sydney Local Health District - NSW ...

2001-02 Annual Report - Sydney Local Health District - NSW ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

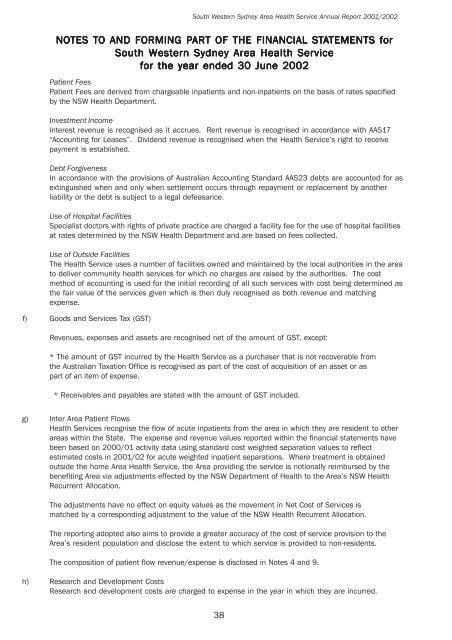

South Western <strong>Sydney</strong> Area <strong>Health</strong> Service <strong>Annual</strong> <strong>Report</strong> <strong>2001</strong>/20<strong>02</strong>NOTES TO AND FORMING PARART OF THE FINANCIAL STATEMENTS TEMENTS forSouth Western <strong>Sydney</strong> Area <strong>Health</strong> Servicefor the year ended 30 June 20<strong>02</strong>Patient FeesPatient Fees are derived from chargeable inpatients and non-inpatients on the basis of rates specifiedby the <strong>NSW</strong> <strong>Health</strong> Department.Investment IncomeInterest revenue is recognised as it accrues. Rent revenue is recognised in accordance with AAS17“Accounting for Leases”. Dividend revenue is recognised when the <strong>Health</strong> Service’s right to receivepayment is established.Debt ForgivenessIn accordance with the provisions of Australian Accounting Standard AAS23 debts are accounted for asextinguished when and only when settlement occurs through repayment or replacement by anotherliability or the debt is subject to a legal defeasance.Use of Hospital FacilitiesSpecialist doctors with rights of private practice are charged a facility fee for the use of hospital facilitiesat rates determined by the <strong>NSW</strong> <strong>Health</strong> Department and are based on fees collected.Use of Outside FacilitiesThe <strong>Health</strong> Service uses a number of facilities owned and maintained by the local authorities in the areato deliver community health services for which no charges are raised by the authorities. The costmethod of accounting is used for the initial recording of all such services with cost being determined asthe fair value of the services given which is then duly recognised as both revenue and matchingexpense.f) Goods and Services Tax (GST)Revenues, expenses and assets are recognised net of the amount of GST, except:* The amount of GST incurred by the <strong>Health</strong> Service as a purchaser that is not recoverable fromthe Australian Taxation Office is recognised as part of the cost of acquisition of an asset or aspart of an item of expense.* Receivables and payables are stated with the amount of GST included.g) Inter Area Patient Flows<strong>Health</strong> Services recognise the flow of acute inpatients from the area in which they are resident to otherareas within the State. The expense and revenue values reported within the financial statements havebeen based on 2000/01 activity data using standard cost weighted separation values to reflectestimated costs in <strong>2001</strong>/<strong>02</strong> for acute weighted inpatient separations. Where treatment is obtainedoutside the home Area <strong>Health</strong> Service, the Area providing the service is notionally reimbursed by thebenefiting Area via adjustments effected by the <strong>NSW</strong> Department of <strong>Health</strong> to the Area’s <strong>NSW</strong> <strong>Health</strong>Recurrent Allocation.The adjustments have no effect on equity values as the movement in Net Cost of Services ismatched by a corresponding adjustment to the value of the <strong>NSW</strong> <strong>Health</strong> Recurrent Allocation.The reporting adopted also aims to provide a greater accuracy of the cost of service provision to theArea’s resident population and disclose the extent to which service is provided to non-residents.The composition of patient flow revenue/expense is disclosed in Notes 4 and 9.h) Research and Development CostsResearch and development costs are charged to expense in the year in which they are incurred.38