notes to the financial statements for the year ... - Investing In Africa

notes to the financial statements for the year ... - Investing In Africa

notes to the financial statements for the year ... - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

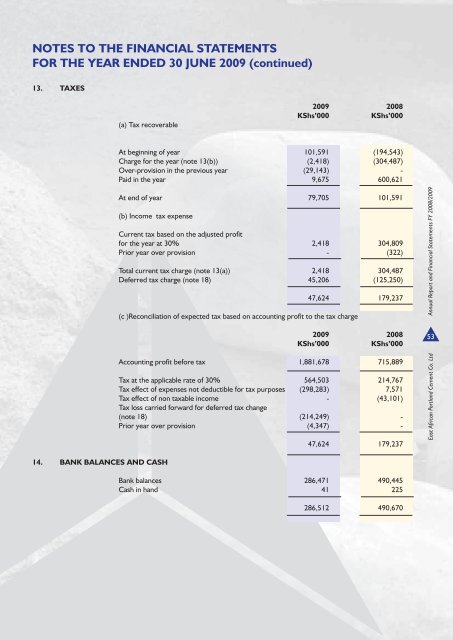

NOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED 30 JUNE 2009 (continued)13. TAXES(a) Tax recoverable2009 2008KShs’000KShs’000At beginning of <strong>year</strong> 101,591 (194,543)Charge <strong>for</strong> <strong>the</strong> <strong>year</strong> (note 13(b)) (2,418) (304,487)Over-provision in <strong>the</strong> previous <strong>year</strong> (29,143) -Paid in <strong>the</strong> <strong>year</strong> 9,675 600,621At end of <strong>year</strong> 79,705 101,591(b) <strong>In</strong>come tax expenseCurrent tax based on <strong>the</strong> adjusted profi t<strong>for</strong> <strong>the</strong> <strong>year</strong> at 30% 2,418 304,809Prior <strong>year</strong> over provision - (322)Total current tax charge (note 13(a)) 2,418 304,487Deferred tax charge (note 18) 45,206 (125,250)47,624 179,237(c ) Reconciliation of expected tax based on accounting profi t <strong>to</strong> <strong>the</strong> tax charge2009 2008KShs’000KShs’000Accounting profi t be<strong>for</strong>e tax 1,881,678 715,889Tax at <strong>the</strong> applicable rate of 30% 564,503 214,767Tax effect of expenses not deductible <strong>for</strong> tax purposes (298,283) 7,571Tax effect of non taxable income - (43,101)Tax loss carried <strong>for</strong>ward <strong>for</strong> deferred tax change(note 18) (214,249) -Prior <strong>year</strong> over provision (4,347) -47,624 179,237East <strong>Africa</strong>n Portland Cement Co. Ltd Annual Report and Financial Statements FY 2008/20095314. BANK BALANCES AND CASHBank balances 286,471 490,445Cash in hand 41 225286,512 490,670