notes to the financial statements for the year ... - Investing In Africa

notes to the financial statements for the year ... - Investing In Africa

notes to the financial statements for the year ... - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

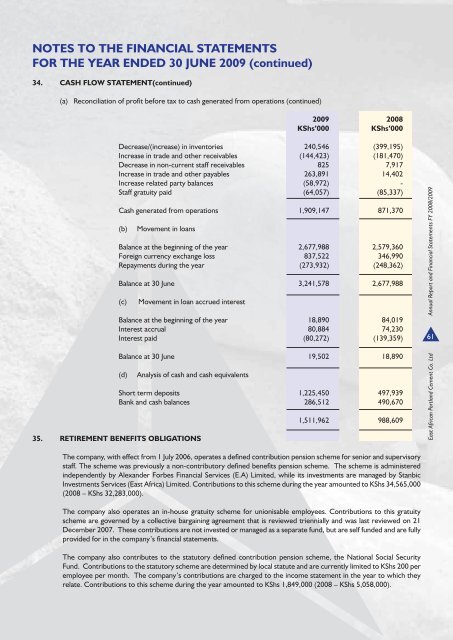

NOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED 30 JUNE 2009 (continued)34. CASH FLOW STATEMENT(continued)(a) Reconciliation of profi t be<strong>for</strong>e tax <strong>to</strong> cash generated from operations (continued)2009 2008KShs’000KShs’000Decrease/(increase) in inven<strong>to</strong>ries 240,546 (399,195)<strong>In</strong>crease in trade and o<strong>the</strong>r receivables (144,423) (181,470)Decrease in non-current staff receivables 825 7,917<strong>In</strong>crease in trade and o<strong>the</strong>r payables 263,891 14,402<strong>In</strong>crease related party balances (58,972) -Staff gratuity paid (64,057) (85,337)Cash generated from operations 1,909,147 871,370(b)Movement in loansBalance at <strong>the</strong> beginning of <strong>the</strong> <strong>year</strong> 2,677,988 2,579,360Foreign currency exchange loss 837,522 346,990Repayments during <strong>the</strong> <strong>year</strong> (273,932) (248,362)Balance at 30 June 3,241,578 2,677,988(c)Movement in loan accrued interestBalance at <strong>the</strong> beginning of <strong>the</strong> <strong>year</strong> 18,890 84,019<strong>In</strong>terest accrual 80,884 74,230<strong>In</strong>terest paid (80,272) (139,359)Balance at 30 June 19,502 18,890(d)Analysis of cash and cash equivalents35. RETIREMENT BENEFITS OBLIGATIONSShort term deposits 1,225,450 497,939Bank and cash balances 286,512 490,6701,511,962 988,609East <strong>Africa</strong>n Portland Cement Co. Ltd Annual Report and Financial Statements FY 2008/200961The company, with effect from 1 July 2006, operates a defi ned contribution pension scheme <strong>for</strong> senior and supervisorystaff. The scheme was previously a non-contribu<strong>to</strong>ry defi ned benefi ts pension scheme. The scheme is administeredindependently by Alexander Forbes Financial Services (E.A) Limited, while its investments are managed by Stanbic<strong>In</strong>vestments Services (East <strong>Africa</strong>) Limited. Contributions <strong>to</strong> this scheme during <strong>the</strong> <strong>year</strong> amounted <strong>to</strong> KShs 34,565,000(2008 – KShs 32,283,000).The company also operates an in-house gratuity scheme <strong>for</strong> unionisable employees. Contributions <strong>to</strong> this gratuityscheme are governed by a collective bargaining agreement that is reviewed triennially and was last reviewed on 21December 2007. These contributions are not invested or managed as a separate fund, but are self funded and are fullyprovided <strong>for</strong> in <strong>the</strong> company’s fi nancial <strong>statements</strong>.The company also contributes <strong>to</strong> <strong>the</strong> statu<strong>to</strong>ry defi ned contribution pension scheme, <strong>the</strong> National Social SecurityFund. Contributions <strong>to</strong> <strong>the</strong> statu<strong>to</strong>ry scheme are determined by local statute and are currently limited <strong>to</strong> KShs 200 peremployee per month. The company’s contributions are charged <strong>to</strong> <strong>the</strong> income statement in <strong>the</strong> <strong>year</strong> <strong>to</strong> which <strong>the</strong>yrelate. Contributions <strong>to</strong> this scheme during <strong>the</strong> <strong>year</strong> amounted <strong>to</strong> KShs 1,849,000 (2008 – KShs 5,058,000).