notes to the financial statements for the year ... - Investing In Africa

notes to the financial statements for the year ... - Investing In Africa

notes to the financial statements for the year ... - Investing In Africa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

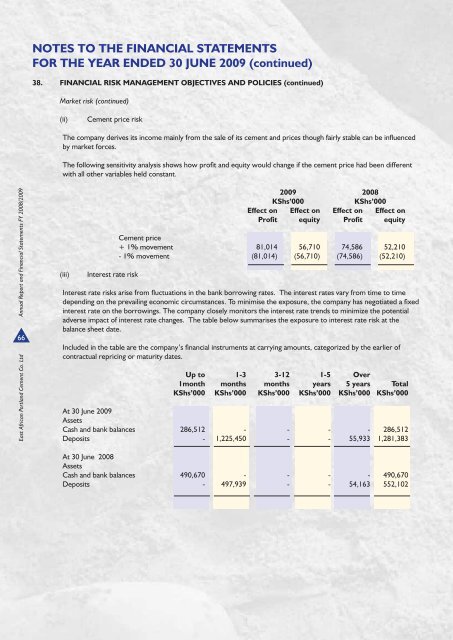

NOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED 30 JUNE 2009 (continued)38. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)Market risk (continued)(ii)Cement price riskThe company derives its income mainly from <strong>the</strong> sale of its cement and prices though fairly stable can be infl uencedby market <strong>for</strong>ces.The following sensitivity analysis shows how profi t and equity would change if <strong>the</strong> cement price had been differentwith all o<strong>the</strong>r variables held constant.East <strong>Africa</strong>n Portland Cement Co. Ltd Annual Report and Financial Statements FY 2008/200966(iii)<strong>In</strong>terest rate risk2009 2008KShs’000KShs’000Effect on Effect on Effect on Effect onProfit equity Profit equityCement price+ 1% movement 81,014 56,710 74,586 52,210- 1% movement (81,014) (56,710) (74,586) (52,210)<strong>In</strong>terest rate risks arise from fl uctuations in <strong>the</strong> bank borrowing rates. The interest rates vary from time <strong>to</strong> timedepending on <strong>the</strong> prevailing economic circumstances. To minimise <strong>the</strong> exposure, <strong>the</strong> company has negotiated a fi xedinterest rate on <strong>the</strong> borrowings. The company closely moni<strong>to</strong>rs <strong>the</strong> interest rate trends <strong>to</strong> minimize <strong>the</strong> potentialadverse impact of interest rate changes. The table below summarises <strong>the</strong> exposure <strong>to</strong> interest rate risk at <strong>the</strong>balance sheet date.<strong>In</strong>cluded in <strong>the</strong> table are <strong>the</strong> company’s fi nancial instruments at carrying amounts, categorized by <strong>the</strong> earlier ofcontractual repricing or maturity dates.Up <strong>to</strong> 1-3 3-12 1-5 Over1month months months <strong>year</strong>s 5 <strong>year</strong>s TotalKShs’000 KShs’000 KShs’000 KShs’000 KShs’000 KShs’000At 30 June 2009AssetsCash and bank balances 286,512 - - - - 286,512Deposits - 1,225,450 - - 55,933 1,281,383At 30 June 2008AssetsCash and bank balances 490,670 - - - - 490,670Deposits - 497,939 - - 54,163 552,102