notes to the financial statements for the year ... - Investing In Africa

notes to the financial statements for the year ... - Investing In Africa

notes to the financial statements for the year ... - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

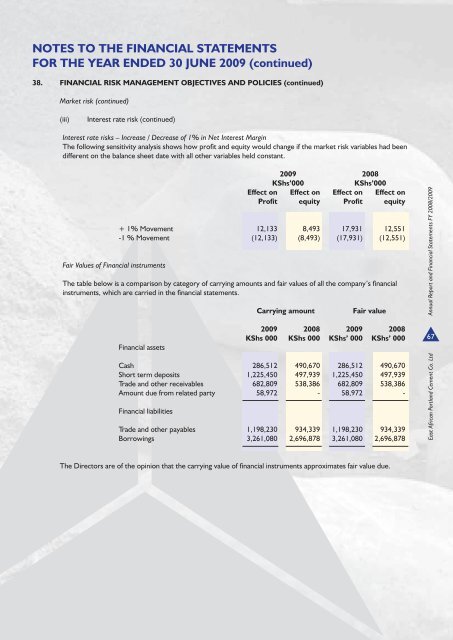

NOTES TO THE FINANCIAL STATEMENTSFOR THE YEAR ENDED 30 JUNE 2009 (continued)38. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)Market risk (continued)(iii)<strong>In</strong>terest rate risk (continued)<strong>In</strong>terest rate risks – <strong>In</strong>crease / Decrease of 1% in Net <strong>In</strong>terest MarginThe following sensitivity analysis shows how profi t and equity would change if <strong>the</strong> market risk variables had beendifferent on <strong>the</strong> balance sheet date with all o<strong>the</strong>r variables held constant.Fair Values of Financial instruments2009 2008KShs’000KShs’000Effect on Effect on Effect on Effect onProfit equity Profit equity+ 1% Movement 12,133 8,493 17,931 12,551-1 % Movement (12,133) (8,493) (17,931) (12,551)The table below is a comparison by category of carrying amounts and fair values of all <strong>the</strong> company’s fi nancialinstruments, which are carried in <strong>the</strong> fi nancial <strong>statements</strong>.Financial assetsCarrying amountFair value2009 2008 2009 2008KShs 000 KShs 000 KShs’ 000 KShs’ 000Cash 286,512 490,670 286,512 490,670Short term deposits 1,225,450 497,939 1,225,450 497,939Trade and o<strong>the</strong>r receivables 682,809 538,386 682,809 538,386Amount due from related party 58,972 - 58,972 -Financial liabilitiesTrade and o<strong>the</strong>r payables 1,198,230 934,339 1,198,230 934,339Borrowings 3,261,080 2,696,878 3,261,080 2,696,878East <strong>Africa</strong>n Portland Cement Co. Ltd Annual Report and Financial Statements FY 2008/200967The Direc<strong>to</strong>rs are of <strong>the</strong> opinion that <strong>the</strong> carrying value of fi nancial instruments approximates fair value due.