Barrier Option Pricing Using Adjusted Transition Probabilities

Barrier Option Pricing Using Adjusted Transition Probabilities

Barrier Option Pricing Using Adjusted Transition Probabilities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

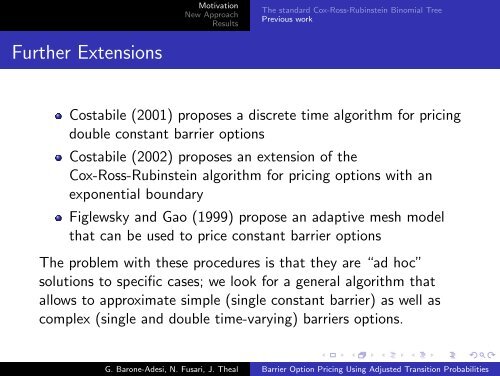

MotivationNew ApproachResultsThe standard Cox-Ross-Rubinstein Binomial TreePrevious workFurther ExtensionsCostabile (2001) proposes a discrete time algorithm for pricingdouble constant barrier optionsCostabile (2002) proposes an extension of theCox-Ross-Rubinstein algorithm for pricing options with anexponential boundaryFiglewsky and Gao (1999) propose an adaptive mesh modelthat can be used to price constant barrier optionsThe problem with these procedures is that they are “ad hoc”solutions to specific cases; we look for a general algorithm thatallows to approximate simple (single constant barrier) as well ascomplex (single and double time-varying) barriers options.G. Barone-Adesi, N. Fusari, J. Theal <strong>Barrier</strong> <strong>Option</strong> <strong>Pricing</strong> <strong>Using</strong> <strong>Adjusted</strong> <strong>Transition</strong> <strong>Probabilities</strong>