Barrier Option Pricing Using Adjusted Transition Probabilities

Barrier Option Pricing Using Adjusted Transition Probabilities

Barrier Option Pricing Using Adjusted Transition Probabilities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

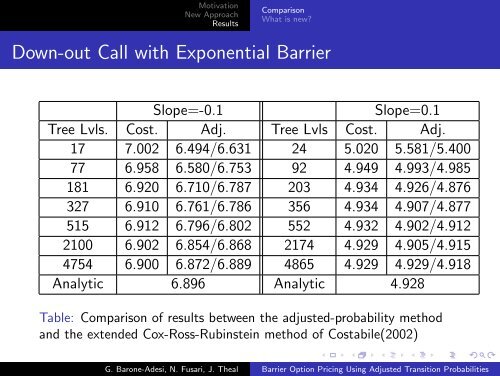

MotivationNew ApproachResultsComparisonWhat is new?Down-out Call with Exponential <strong>Barrier</strong>Slope=-0.1Slope=0.1Tree Lvls. Cost. Adj. Tree Lvls Cost. Adj.17 7.002 6.494/6.631 24 5.020 5.581/5.40077 6.958 6.580/6.753 92 4.949 4.993/4.985181 6.920 6.710/6.787 203 4.934 4.926/4.876327 6.910 6.761/6.786 356 4.934 4.907/4.877515 6.912 6.796/6.802 552 4.932 4.902/4.9122100 6.902 6.854/6.868 2174 4.929 4.905/4.9154754 6.900 6.872/6.889 4865 4.929 4.929/4.918Analytic 6.896 Analytic 4.928Table: Comparison of results between the adjusted-probability methodand the extended Cox-Ross-Rubinstein method of Costabile(2002)G. Barone-Adesi, N. Fusari, J. Theal <strong>Barrier</strong> <strong>Option</strong> <strong>Pricing</strong> <strong>Using</strong> <strong>Adjusted</strong> <strong>Transition</strong> <strong>Probabilities</strong>