Barrier Option Pricing Using Adjusted Transition Probabilities

Barrier Option Pricing Using Adjusted Transition Probabilities

Barrier Option Pricing Using Adjusted Transition Probabilities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

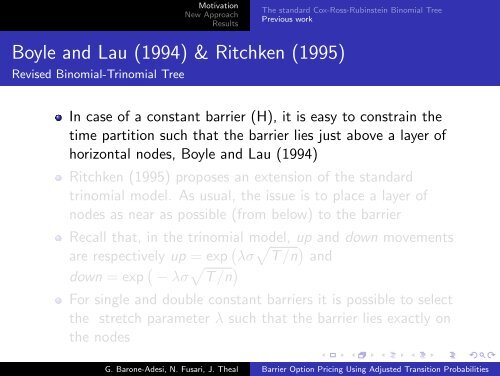

MotivationNew ApproachResultsThe standard Cox-Ross-Rubinstein Binomial TreePrevious workBoyle and Lau (1994) & Ritchken (1995)Revised Binomial-Trinomial TreeIn case of a constant barrier (H), it is easy to constrain thetime partition such that the barrier lies just above a layer ofhorizontal nodes, Boyle and Lau (1994)Ritchken (1995) proposes an extension of the standardtrinomial model. As usual, the issue is to place a layer ofnodes as near as possible (from below) to the barrierRecall that, in the trinomial model, up and down movementsare respectively up = exp ( λσ √ T /n ) anddown = exp ( − λσ √ T /n )For single and double constant barriers it is possible to selectthe stretch parameter λ such that the barrier lies exactly onthe nodesG. Barone-Adesi, N. Fusari, J. Theal <strong>Barrier</strong> <strong>Option</strong> <strong>Pricing</strong> <strong>Using</strong> <strong>Adjusted</strong> <strong>Transition</strong> <strong>Probabilities</strong>