Barrier Option Pricing Using Adjusted Transition Probabilities

Barrier Option Pricing Using Adjusted Transition Probabilities

Barrier Option Pricing Using Adjusted Transition Probabilities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

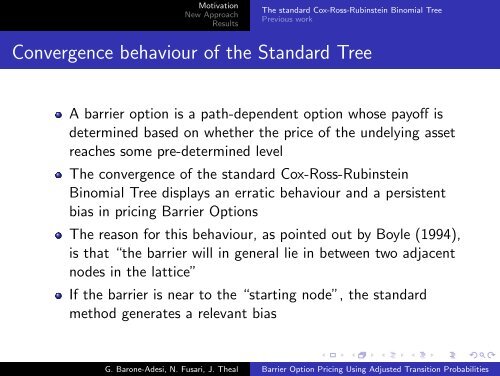

MotivationNew ApproachResultsThe standard Cox-Ross-Rubinstein Binomial TreePrevious workConvergence behaviour of the Standard TreeA barrier option is a path-dependent option whose payoff isdetermined based on whether the price of the undelying assetreaches some pre-determined levelThe convergence of the standard Cox-Ross-RubinsteinBinomial Tree displays an erratic behaviour and a persistentbias in pricing <strong>Barrier</strong> <strong>Option</strong>sThe reason for this behaviour, as pointed out by Boyle (1994),is that “the barrier will in general lie in between two adjacentnodes in the lattice”If the barrier is near to the “starting node”, the standardmethod generates a relevant biasG. Barone-Adesi, N. Fusari, J. Theal <strong>Barrier</strong> <strong>Option</strong> <strong>Pricing</strong> <strong>Using</strong> <strong>Adjusted</strong> <strong>Transition</strong> <strong>Probabilities</strong>