Auditors' ReportThe Members of <strong>Lumax</strong> DK <strong>Auto</strong> Industries LimitedWe have audited the attached Balance Sheet of <strong>Lumax</strong> DK <strong>Auto</strong>Industries Limited as at <strong>31</strong>st <strong>March</strong>, <strong>2008</strong> and also the Profit and LossAccount and Cash Flow Statement for the year ended on that dateannexed thereto. These financial statements are the responsibility ofthe company's management. Our responsibility is to express anopinion on these financial statements based on our audit.We conducted our audit in accordance with auditing standardsgenerally accepted in India. Those standards require that we plan andperform the audit to obtain reasonable assurance about whether thefinancial statements are free of material misstatement. An auditincludes examining, on a test basis, evidence supporting the amountsand disclosures in the financial statements. An audit also includesassessing the accounting principles used and significant estimatesmade by management, as well as evaluating the overall financialstatement presentation. We believe that our audit provides areasonable basis for our opinion.As required by the Companies (Auditor's Report) Order, 2003 issuedby the Central Government in terms of Section 227(4A) of theCompanies Act, 1956, and on the basis of such checks as weconsidered appropriate and according to the information andexplanations given to us, we enclose in the Annexure a statement onthe matters specified in paragraph 4 and 5 of the said order to theextent applicable.Further to our comments in the Annexure referred to in paragraphabove, we report that;a) We have obtained all the information and explanations, w h i c hto the best of our knowledge and belief were necessary for thepurpose of our audit.b) In our opinion, proper books of account, as required by law,have been kept by the company, so far as appears from ourexamination of the books.c) The Balance Sheet, Profit & Loss Account and Cash FlowStatement dealt with by this report are in agreement with theBooks of Account.d) The Balance Sheet, Profit & Loss Account and Cash FlowStatement are in compliance with the mandatory AccountingStandards referred to in section 211 (3C) of the CompaniesAct, 1956 to the extent applicable.e) On the basis of written representations received fromDirectors, we report that none of the Directors is disqualifiedas on <strong>March</strong> <strong>31</strong>, <strong>2008</strong> from being appointed as a directorunder clause (g) of sub-section (1) of section 274 of theCompanies Act, 1956.f) In our opinion and to the best of our information and accordingto the explanations given to us, the said financial statementstogether with the notes thereon and attached thereto give inthe prescribed manner the information required by the Act andgive a true and fair view in conformity with the accountingprinciples generally accepted in India:i) in the case of Balance Sheet, of the State of Affairs of theCompany as at <strong>March</strong> <strong>31</strong>, <strong>2008</strong>;ii) in the case of Profit and Loss Account, of the profit for theyear ended on that date; andiii) in the case of Cash Flow Statement, of the Cash Flows for theyear ended on that date.Rajesh SethiPartnerMembership No. 85669For and on behalf ofPlace: GurgaonJ.C. Bhalla & Co.Date: June 28, <strong>2008</strong>Chartered AccountantsAnnexure to the Auditors' Report on the accounts of <strong>Lumax</strong> DK<strong>Auto</strong> Industries Limited for the year ended <strong>31</strong>st <strong>March</strong> <strong>2008</strong> asreferred to in our report of even date.(i)(ii)(iii)(iv)(a) The company is maintaining proper records showing fullparticulars including quantitative details and situation offixed assets.(b) The fixed assets have been physically verified by themanagement at the year-end. We are informed that nomaterial discrepancies have been noticed by themanagement on such verification as compared with therecord of fixed assets maintained by the company.(c) The company has not disposed off substantial part of fixedassets during the year.(a) The inventory (excluding stock with third parties which hasbeen substantially confirmed by them) has been physicallyverified by the management at reasonable intervals.(b) In our opinion, the procedures of physical verification ofinventory followed by the management were adequate inrelation to the size of the company and the nature of itsbusiness.(c) The company is maintaining proper records of inventory.The discrepancies noticed on physical verification of stocksas compared to book records were not material and havebeen properly dealt with in the books of account.(a) According to the information and explanations given to us,the company has not granted any loans, secured orunsecured to any company, firms or other parties covered inthe register maintained under section 301 of the CompaniesAct, 1956.(b) As the company has not granted any loans, secured orunsecured to companies, firms or other parties covered inthe register maintained under section 301 of the CompaniesAct, 1956, the provisions of para 4 (iii)(b), (iii)(c) and (iii)(d) ofthe Order are not applicable to the company.(c) According to the information and explanations given to us,the company has taken an unsecured loan from a companycovered in the register maintained under Section 301 of theCompanies Act, 1956. The maximum amount involvedduring the year was Rs. 15 Lakhs and year-end balance ofloan taken from such party was Rs. 15 Lakhs.(d) In our opinion, the rate of interest and other terms andconditions of loan taken by the company are not prima facieprejudicial to the interest of the company.(e) The company is regular in repayment of the principal andinterest as stipulated.In our opinion and according to the information and explanationsgiven to us there are adequate internal control procedurescommensurate with the size of the company and the nature of itsbusiness for the purchase of inventory and fixed assets and forthe sale of goods. The clause relating to sales of service is notapplicable to the company. Further, in our opinion, there is nocontinuing failure to correct major weaknesses in internalcontrol system.46

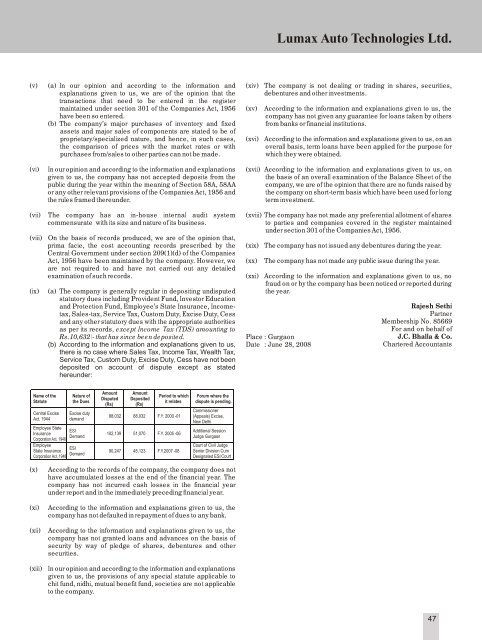

<strong>Lumax</strong> <strong>Auto</strong> <strong>Technologies</strong> <strong>Ltd</strong>.(v)(a) In our opinion and according to the information andexplanations given to us, we are of the opinion that thetransactions that need to be entered in the registermaintained under section 301 of the Companies Act, 1956have been so entered.(b) The company’s major purchases of inventory and fixedassets and major sales of components are stated to be ofproprietary/specialized nature, and hence, in such cases,the comparison of prices with the market rates or withpurchases from/sales to other parties can not be made.(xiv)(xv)(xvi)The company is not dealing or trading in shares, securities,debentures and other investments.According to the information and explanations given to us, thecompany has not given any guarantee for loans taken by othersfrom banks or financial institutions.According to the information and explanations given to us, on anoverall basis, term loans have been applied for the purpose forwhich they were obtained.(vi)(vii)(viii)(ix)In our opinion and according to the information and explanationsgiven to us, the company has not accepted deposits from thepublic during the year within the meaning of Section 58A, 58AAor any other relevant provisions of the Companies Act, 1956 andthe rules framed thereunder.The company has an in-house internal audit systemcommensurate with its size and nature of its business.On the basis of records produced, we are of the opinion that,prima facie, the cost accounting records prescribed by theCentral Government under section 209(1)(d) of the CompaniesAct, 1956 have been maintained by the company. However, weare not required to and have not carried out any detailedexamination of such records.(a) The company is generally regular in depositing undisputedstatutory dues including Provident Fund, Investor Educationand Protection Fund, Employee’s State Insurance, Incometax,Sales-tax, Service Tax, Custom Duty, Excise Duty, Cessand any other statutory dues with the appropriate authoritiesas per its records, except Income Tax (TDS) amounting toRs.10,632/- that has since been deposited.(b) According to the information and explanations given to us,there is no case where Sales Tax, Income Tax, Wealth Tax,Service Tax, Custom Duty, Excise Duty, Cess have not beendeposited on account of dispute except as statedhereunder:(xvii) According to the information and explanations given to us, onthe basis of an overall examination of the Balance Sheet of thecompany, we are of the opinion that there are no funds raised bythe company on short-term basis which have been used for longterm investment.(xviii) The company has not made any preferential allotment of sharesto parties and companies covered in the register maintainedunder section 301 of the Companies Act, 1956.(xix)(xx)(xxi)The company has not issued any debentures during the year.The company has not made any public issue during the year.According to the information and explanations given to us, nofraud on or by the company has been noticed or reported duringthe year.Place : GurgaonDate : June 28, <strong>2008</strong>Rajesh SethiPartnerMembership No. 85669For and on behalf ofJ.C. Bhalla & Co.Chartered AccountantsName of theStatuteCentral ExciseAct, 1944Employee StateInsuranceCorporation Act, 1948Nature ofthe DuesExcise dutydemandESIDemandEmployeeESIState InsuranceDemandCorporation Act, 1948AmountDisputed(Rs)AmountDeposited(Rs)Period to whichit relates88,032 88,032 F.Y. 2000 -01102,139 51,070 F.Y. 2005 -0690,247 45,123 F.Y.2007 -08Forum where thedispute is pending.Commissioner(Appeals) Excise,New DelhiAdditional SessionJudge GurgaonCourt of Civil JudgeSenior Division CumDesignated ESI Court(x)(xi)(xii)(xiii)According to the records of the company, the company does nothave accumulated losses at the end of the financial year. Thecompany has not incurred cash losses in the financial yearunder report and in the immediately preceding financial year.According to the information and explanations given to us, thecompany has not defaulted in repayment of dues to any bank.According to the information and explanations given to us, thecompany has not granted loans and advances on the basis ofsecurity by way of pledge of shares, debentures and othersecurities.In our opinion and according to the information and explanationsgiven to us, the provisions of any special statute applicable tochit fund, nidhi, mutual benefit fund, societies are not applicableto the company.47