Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

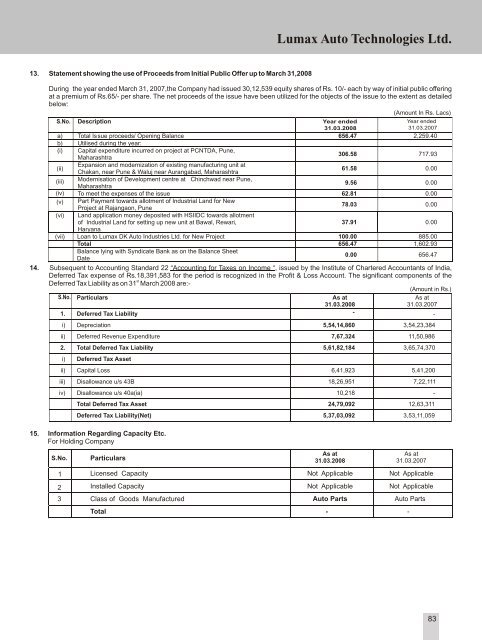

<strong>Lumax</strong> <strong>Auto</strong> <strong>Technologies</strong> <strong>Ltd</strong>.13. Statement showing the use of Proceeds from Initial Public Offer up to <strong>March</strong> <strong>31</strong>,<strong>2008</strong>During the year ended <strong>March</strong> <strong>31</strong>, 2007,the Company had issued 30,12,539 equity shares of Rs. 10/- each by way of initial public offeringat a premium of Rs.65/- per share. The net proceeds of the issue have been utilized for the objects of the issue to the extent as detailedbelow:(Amount In Rs. Lacs)S.No. Description<strong>Year</strong> ended<strong>31</strong>.03.<strong>2008</strong><strong>Year</strong> ended<strong>31</strong>.03.2007a) Total Issue proceeds/ Opening Balance 656.47 2,259.40b) Utilised during the year:(i) Capital expenditure incurred on project at PCNTDA, Pune,Maharashtra306.58 717.93(ii)Expansion and modernization of existing manufacturing unit atChakan, near Pune & Waluj near Aurangabad, Maharashtra61.58 0.00(iii) Modernisation of Development centre at Chinchwad near Pune,Maharashtra9.56 0.00(iv) To meet the expenses of the issue 62.81 0.00(v) Part Payment towards allotment of Industrial Land for NewProject at Rajangaon, Pune78.03 0.00(vi) Land application money deposited with HSIIDC towards allotmentof Industrial Land for setting up new unit at Bawal, Rewari,37.91 0.00Haryana(vii) Loan to <strong>Lumax</strong> DK <strong>Auto</strong> Industries <strong>Ltd</strong>. for New Project 100.00 885.00Total 656.47 1,602.93Balance lying with Syndicate Bank as on the Balance SheetDate0.00 656.4714. Subsequent to Accounting Standard 22 “Accounting for Taxes on Income “, issued by the Institute of Chartered Accountants of India,Deferred Tax expense of Rs.18,391,583 for the period is recognized in the Profit & Loss Account. The significant components of thestDeferred Tax Liability as on <strong>31</strong> <strong>March</strong> <strong>2008</strong> are:-(Amount in Rs.)S.No. ParticularsAs atAs at<strong>31</strong>.03.<strong>2008</strong><strong>31</strong>.03.20071. Deferred Tax Liability--i)ii)2.i)ii)iii)iv)DepreciationDeferred Revenue ExpenditureTotal Deferred Tax LiabilityDeferred Tax AssetCapital LossDisallowance u/s 43BDisallowance u/s 40a(ia)Total Deferred Tax AssetDeferred Tax Liability(Net)5,54,14,8607,67,3245,61,82,1846,41,92<strong>31</strong>8,26,95110,21824,79,0925,37,03,0923,54,23,38411,50,9863,65,74,3705,41,2007,22,111-12,63,<strong>31</strong>13,53,11,05915. Information Regarding Capacity Etc.For Holding CompanyS.No.ParticularsAs at<strong>31</strong>.03.<strong>2008</strong>As at<strong>31</strong>.03.20071Licensed CapacityNot ApplicableNot Applicable2Installed CapacityNot ApplicableNot Applicable3Class of Goods Manufactured<strong>Auto</strong> Parts<strong>Auto</strong> PartsTotal--83