Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

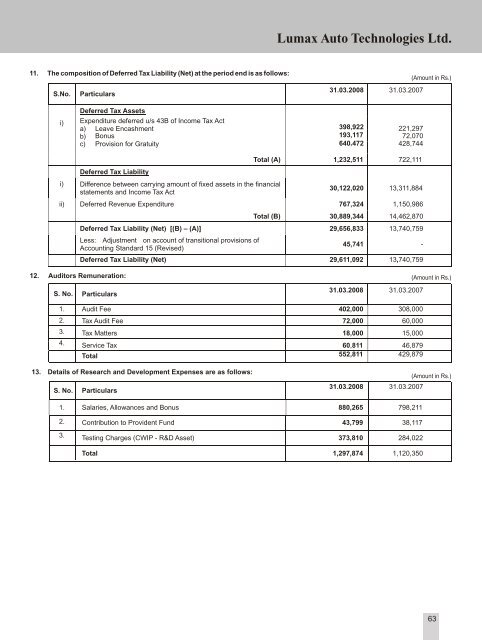

<strong>Lumax</strong> <strong>Auto</strong> <strong>Technologies</strong> <strong>Ltd</strong>.11. The composition of Deferred Tax Liability (Net) at the period end is as follows:S.No.Particulars<strong>31</strong>.03.<strong>2008</strong><strong>31</strong>.03.2007(Amount in Rs.)Deferred Tax Assetsi) Expenditure deferred u/s 43B of Income Tax Acta) Leave Encashment398,922b) Bonus193,117c) Provision for Gratuity 640,472221,29772,070428,744Deferred Tax Liabilityi) Difference between carrying amount of fixed assets in the financialstatements and Income Tax ActTotal (A) 1,232,511 722,11130,122,020 13,<strong>31</strong>1,884ii) Deferred Revenue Expenditure 767,324 1,150,986Total (B) 30,889,344 14,462,870Deferred Tax Liability (Net) [(B) – (A)] 29,656,833 13,740,759Less: Adjustment on account of transitional provisions ofAccounting Standard 15 (Revised)45,741 -Deferred Tax Liability (Net) 29,611,092 13,740,75912. Auditors Remuneration:S. No.Particulars<strong>31</strong>.03.<strong>2008</strong> <strong>31</strong>.03.2007(Amount in Rs.)1.2.3.4.Audit Fee402,000Tax Audit Fee72,000Tax Matters18,000Service Tax60,811Total 552,811308,00060,00015,00046,879429,87913. Details of Research and Development Expenses are as follows:S. No.Particulars<strong>31</strong>.03.<strong>2008</strong> <strong>31</strong>.03.2007(Amount in Rs.)1.Salaries, Allowances and Bonus880,265798,2112.Contribution to Provident Fund43,79938,1173.Testing Charges (CWIP - R&D Asset)373,810284,022Total1,297,8741,120,35063