Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

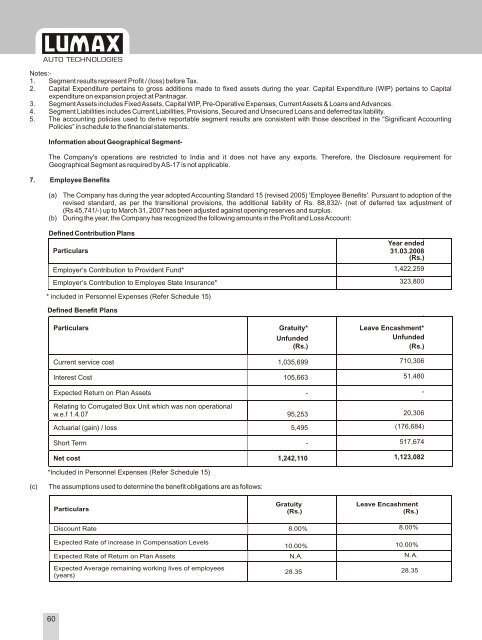

Notes:-1. Segment results represent Profit / (loss) before Tax.2. Capital Expenditure pertains to gross additions made to fixed assets during the year. Capital Expenditure (WIP) pertains to Capitalexpenditure on expansion project at Pantnagar.3. Segment Assets includes Fixed Assets, Capital WIP, Pre-Operative Expenses, Current Assets & Loans and Advances.4. Segment Liabilities includes Current Liabilities, Provisions, Secured and Unsecured Loans and deferred tax liability.5. The accounting policies used to derive reportable segment results are consistent with those described in the “Significant AccountingPolicies” in schedule to the financial statements.Information about Geographical Segment-The Company's operations are restricted to India and it does not have any exports. Therefore, the Disclosure requirement forGeographical Segment as required by AS-17 is not applicable.7. Employee Benefits(a)(b)The Company has during the year adopted Accounting Standard 15 (revised 2005) 'Employee Benefits'. Pursuant to adoption of therevised standard, as per the transitional provisions, the additional liability of Rs. 88,832/- (net of deferred tax adjustment of(Rs 45,741/-) up to <strong>March</strong> <strong>31</strong>, 2007 has been adjusted against opening reserves and surplus.During the year, the Company has recognized the following amounts in the Profit and Loss Account:Defined Contribution PlansParticularsEmployer’s Contribution to Provident Fund*Employer’s Contribution to Employee State Insurance*<strong>Year</strong> ended<strong>31</strong>.03.<strong>2008</strong>(Rs.)1,422,259323,800* included in Personnel Expenses (Refer Schedule 15)Defined Benefit PlansParticularsCurrent service costInterest CostExpected Return on Plan AssetsRelating to Corrugated Box Unit which was non operationalw.e.f 1.4.07Actuarial (gain) / lossShort TermNet cost*Included in Personnel Expenses (Refer Schedule 15)Gratuity*Unfunded(Rs.)1,035,699105,663-95,2535,495-1,242,110Leave Encashment*Unfunded(Rs.)710,30651,480-20,306(176,684)517,6741,123,082(c)The assumptions used to determine the benefit obligations are as follows:ParticularsGratuity(Rs.)Leave Encashment(Rs.)Discount Rate 8.00%8.00%Expected Rate of increase in Compensation LevelsExpected Rate of Return on Plan AssetsExpected Average remaining working lives of employees(years)10.00%N.A.28.3510.00%N.A.28.3560