Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Year Ended March 31, 2008 - Lumax Auto Technologies Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

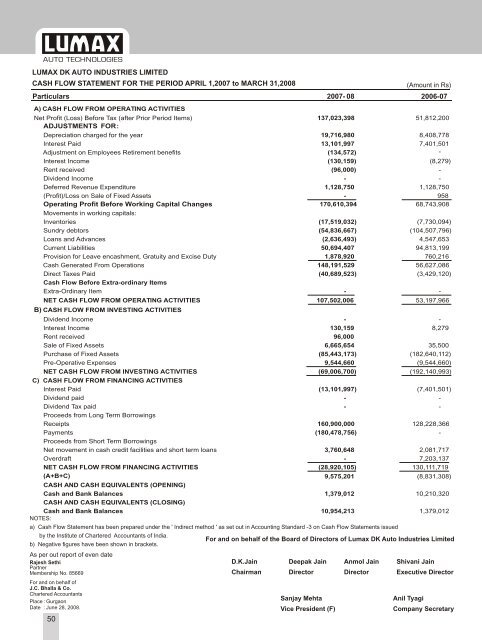

LUMAX DK AUTO INDUSTRIES LIMITEDCASH FLOW STATEMENT FOR THE PERIOD APRIL 1,2007 to MARCH <strong>31</strong>,<strong>2008</strong>A) CASH FLOW FROM OPERATING ACTIVITIESFor and on behalf of the Board of Directors of <strong>Lumax</strong> DK <strong>Auto</strong> Industries LimitedD.K.Jain Deepak Jain Anmol Jain Shivani JainChairman Director Director Executive DirectorSanjay MehtaVice President (F)(Amount in Rs)Particulars 2007- 08 2006-07Net Profit (Loss) Before Tax (after Prior Period Items) 137,023,398 51,812,200ADJUSTMENTS FOR :Depreciation charged for the year 19,716,980 8,408,778Interest Paid 13,101,997 7,401,501Adjustment on Employees Retirement benefits (134,572)-Interest Income (130,159) (8,279)Rent received (96,000) -Dividend Income - -Deferred Revenue Expenditure 1,128,750 1,128,750(Profit)/Loss on Sale of Fixed Assets - 958Operating Profit Before Working Capital Changes170,610,394 68,743,908Movements in working capitals:Inventories (17,519,032) (7,730,094)Sundry debtors (54,836,667)(104,507,796)Loans and Advances (2,636,493) 4,547,653Current Liabilities 50,694,407 94,813,199Provision for Leave encashment, Gratuity and Excise Duty 1,878,920 760,216Cash Generated From Operations 148,191,529 56,627,086Direct Taxes Paid (40,689,523) (3,429,120)Cash Flow Before Extra-ordinary ItemsExtra-Ordinary Item - -NET CASH FLOW FROM OPERATING ACTIVITIES 107,502,006 53,197,966B) CASH FLOW FROM INVESTING ACTIVITIESDividend Income - -Interest Income 130,159 8,279Rent received 96,000Sale of Fixed Assets 6,665,654 35,500Purchase of Fixed Assets (85,443,173) (182,640,112)Pre-Operative Expenses 9,544,660 (9,544,660)NET CASH FLOW FROM INVESTING ACTIVITIES (69,006,700) (192,140,993)C) CASH FLOW FROM FINANCING ACTIVITIESInterest Paid (13,101,997) (7,401,501)Dividend paid - -Dividend Tax paid - -Proceeds from Long Term BorrowingsReceipts 160,900,000 128,228,366Payments (180,478,756) -Proceeds from Short Term BorrowingsNet movement in cash credit facilities and short term loans 3,760,648 2,081,717Overdraft - 7,203,137NET CASH FLOW FROM FINANCING ACTIVITIES(28,920,105) 130,111,719(A+B+C)9,575,201 (8,8<strong>31</strong>,308)CASH AND CASH EQUIVALENTS (OPENING)Cash and Bank BalancesCASH AND CASH EQUIVALENTS (CLOSING)Cash and Bank Balances1,379,01210,954,21<strong>31</strong>0,210,3201,379,012NOTES:a) Cash Flow Statement has been prepared under the ' Indirect method ' as set out in Accounting Standard -3 on Cash Flow Statements issuedby the Institute of Chartered Accountants of India.b) Negative figures have been shown in brackets.As per out report of even dateRajesh SethiPartnerMembership No. 85669For and on behalf ofJ.C. Bhalla & Co.Chartered AccountantsPlace : GurgaonDate : June 28, <strong>2008</strong>.50Anil TyagiCompany Secretary