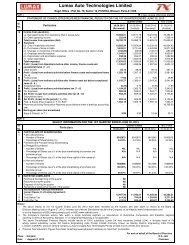

Q) Provisions and Contingent Liabilities:Provisions are recognised for liabilities that can be measured only by using a substantial degree of estimation, ifa) the Company has a present obligation as a result of a past event,b) a probable outflow of resources is expected to settle the obligation; andc) the amount of the obligation can be reliably estimated.Contingent liability is disclosed in case ofa) a present obligation arising from past events, when it is not probable that an outflow of resources will be required to settle theobligation,b) a present obligation when no reliable estimate is possible; andc) a possible obligation arising from past events where the probability of outflow of resources is not remote.2. Contingent Liabilities not provided forS.No.i)ii)iii)iv)v)ParticularsProvision for Income Tax assessment dues (Appeal pending withTribunal for the Financial year 2001 - 02)Corporate Guarantee given for Loans taken by Subsidiary company<strong>Lumax</strong> DK <strong>Auto</strong> Industries Limited.Capital Commitment Net of AdvanceExcise Duty (For Subsidiary)Employee State Insurance Demand (For Subsidiary)2007-080.401007.6458.200.881.47(Amount Rs. in Lacs)2006-070.40--0.881.02Based on the favorable decisions in similar cases/legal opinions taken by the Company, the company believes that it has good cases inrespect of the items listed under (i), (iv) & (v) above and hence no provision there against is considered necessary.3. Details in respect of Opening Stock, Production, turnover & closing Stock of Finished Goods: As Per Annexure-A.( Certified by Management )4. Details in respect of consumption of Raw Materials and Consumables and others: As per Annexure –B. ( Certified by Management )5. In terms of Paragraph-3 Part-II of Schedule VI of the Companies Act 1956, quantity wise disclosure have been restricted to thoseitems/articles which individually account for 10% or more of the total Sales, Consumption as the case may be and the same is disclosed tothe extent available and considered as compiled and certified by the management.6. Micro, Small EnterprisesFor Holding CompanyMicro & Small enterprises as defined under the Micro , Small and Medium Enterprises Development Act, 2006(MSMED) have beenidentified to the extent of information available with the company . This has been relied upon by the auditors.Sundry Creditors include following amounts due to MSMED parties:<strong>Year</strong> <strong>Ended</strong> <strong>March</strong> <strong>31</strong>, <strong>2008</strong> (Amount In Rs.)S.No Particulars Principal Interest TotalA The outstanding dues to micro and small enterprises .174,572 1291 1,75,863BCDEPrincipal amount and Interest due thereon remaining unpaid as at end ofthe yearAmount of Interest paid in terms of Section 16 of MSMED Act alongwiththe amount of the payment made to supplier beyond appointed dayOutstanding Interest (Where principal amount has been paid off to thesupplier but interest amount is outstanding as on <strong>March</strong> <strong>31</strong>, <strong>2008</strong>)Total Interest out standing as on <strong>March</strong> <strong>31</strong>, <strong>2008</strong> (Interest in ‘b’ + interest in ‘d’above)For Subsidiary Company :The Company has not received information from vendors regarding their status under the Micro, Small and Medium EnterprisesDevelopment Act, 2006 and hence disclosure relating to amounts unpaid as at the year end together with interest paid/payable under thisAct and as required by Schedule VI of Companies Act, 1956 have not been given.7. The Balances of parties are subject to confirmations.1291 Nil 1291Nil Nil NilNil 1,291 1291Nil 1,291 12918. None of the Employees was in receipt of Remuneration more than Rs.24.00 Lacs per annum, if employed throughout the year or Rs.2.00Lacs per month if employed for part of the month.80

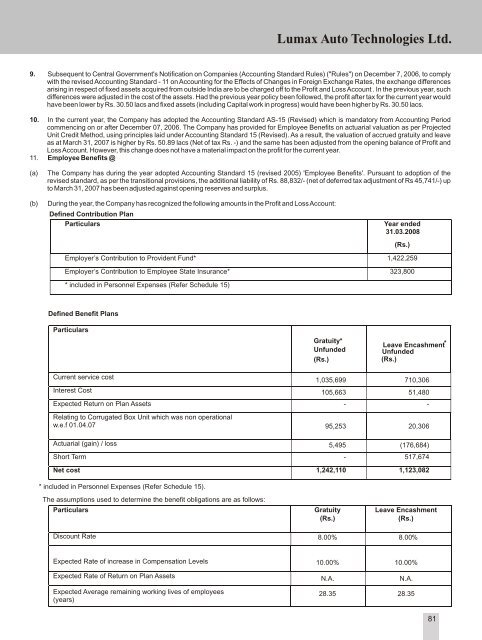

<strong>Lumax</strong> <strong>Auto</strong> <strong>Technologies</strong> <strong>Ltd</strong>.9. Subsequent to Central Government's Notification on Companies (Accounting Standard Rules) ("Rules") on December 7, 2006, to complywith the revised Accounting Standard - 11 on Accounting for the Effects of Changes in Foreign Exchange Rates, the exchange differencesarising in respect of fixed assets acquired from outside India are to be charged off to the Profit and Loss Account . In the previous year, suchdifferences were adjusted in the cost of the assets. Had the previous year policy been followed, the profit after tax for the current year wouldhave been lower by Rs. 30.50 lacs and fixed assets (including Capital work in progress) would have been higher by Rs. 30.50 lacs.10. In the current year, the Company has adopted the Accounting Standard AS-15 (Revised) which is mandatory from Accounting Periodcommencing on or after December 07, 2006. The Company has provided for Employee Benefits on actuarial valuation as per ProjectedUnit Credit Method, using principles laid under Accounting Standard 15 (Revised). As a result, the valuation of accrued gratuity and leaveas at <strong>March</strong> <strong>31</strong>, 2007 is higher by Rs. 50.89 lacs (Net of tax Rs. -) and the same has been adjusted from the opening balance of Profit andLoss Account. However, this change does not have a material impact on the profit for the current year.11. Employee Benefits @(a)(b)The Company has during the year adopted Accounting Standard 15 (revised 2005) 'Employee Benefits'. Pursuant to adoption of therevised standard, as per the transitional provisions, the additional liability of Rs. 88,832/- (net of deferred tax adjustment of Rs 45,741/-) upto <strong>March</strong> <strong>31</strong>, 2007 has been adjusted against opening reserves and surplus.During the year, the Company has recognized the following amounts in the Profit and Loss Account:Defined Contribution PlanParticulars <strong>Year</strong> ended<strong>31</strong>.03.<strong>2008</strong>(Rs.)Employer’s Contribution to Provident Fund*Employer’s Contribution to Employee State Insurance*1,422,259323,800* included in Personnel Expenses (Refer Schedule 15)Defined Benefit PlansParticularsGratuity*Unfunded(Rs.)Leave Encashment *Unfunded(Rs.)Current service cost1,035,699 710,306Interest Cost 105,663 51,480Expected Return on Plan Assets - -Relating to Corrugated Box Unit which was non operationalw.e.f 01.04.07 95,253 20,306Actuarial (gain) / loss 5,495 (176,684)Short Term - 517,674Net cost 1,242,110 1,123,082* included in Personnel Expenses (Refer Schedule 15).The assumptions used to determine the benefit obligations are as follows:ParticularsGratuity(Rs.)Leave Encashment(Rs.)Discount Rate 8.00% 8.00%Expected Rate of increase in Compensation Levels 10.00% 10.00%Expected Rate of Return on Plan Assets N.A. N.A.Expected Average remaining working lives of employees(years)28.35 28.3581