BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

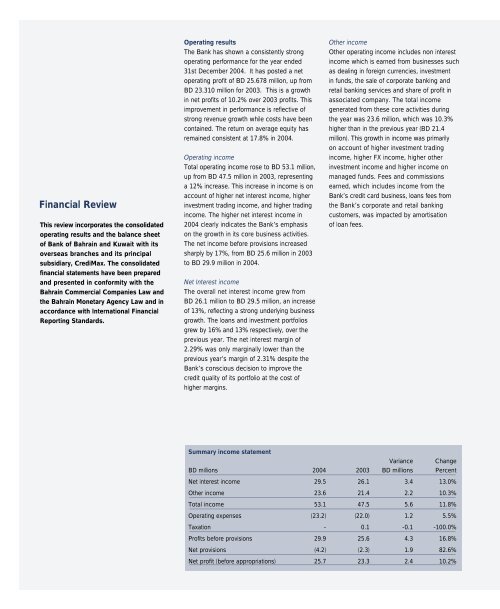

Financial ReviewThis review incorporates the consolidatedoperating results and the balance sheetof Bank of Bahrain and Kuwait with itsoverseas branches and its principalsubsidiary, CrediMax. The consolidatedfinancial statements have been preparedand presented in conformity with theBahrain Commercial Companies Law andthe Bahrain Monetary Agency Law and inaccordance with International FinancialReporting Standards.Operating resultsThe Bank has shown a consistently strongoperating performance for the year ended31st December 2004. It has posted a netoperating profit of BD 25.678 million, up fromBD 23.310 million for 2003. This is a growthin net profits of 10.2% over 2003 profits. Thisimprovement in performance is reflective ofstrong revenue growth while costs have beencontained. The return on average equity hasremained consistent at 17.8% in 2004.Operating incomeTotal operating income rose to BD 53.1 million,up from BD 47.5 million in 2003, representinga 12% increase. This increase in income is onaccount of higher net interest income, higherinvestment trading income, and higher tradingincome. The higher net interest income in2004 clearly indicates the Bank’s emphasison the growth in its core business activities.The net income before provisions increasedsharply by 17%, from BD 25.6 million in 2003to BD 29.9 million in 2004.Net Interest incomeThe overall net interest income grew fromBD 26.1 million to BD 29.5 million, an increaseof 13%, reflecting a strong underlying businessgrowth. The loans and investment portfoliosgrew by 16% and 13% respectively, over theprevious year. The net interest margin of2.29% was only marginally lower than theprevious year’s margin of 2.31% despite theBank’s conscious decision to improve thecredit quality of its portfolio at the cost ofhigher margins.Other incomeOther operating income includes non interestincome which is earned from businesses suchas dealing in foreign currencies, investmentin funds, the sale of corporate banking andretail banking services and share of profit inassociated company. The total incomegenerated from these core activities duringthe year was 23.6 million, which was 10.3%higher than in the previous year (BD 21.4million). This growth in income was primarilyon account of higher investment tradingincome, higher FX income, higher otherinvestment income and higher income onmanaged funds. Fees and commissionsearned, which includes income from theBank’s credit card business, loans fees fromthe Bank’s corporate and retail bankingcustomers, was impacted by amortisationof loan fees.Summary income statementVariance ChangeBD millions 2004 2003 BD millions PercentNet interest income 29.5 26.1 3.4 13.0%Other income 23.6 21.4 2.2 10.3%Total income 53.1 47.5 5.6 11.8%Operating expenses (23.2) (22.0) 1.2 5.5%Taxation - 0.1 -0.1 -100.0%Profits before provisions 29.9 25.6 4.3 16.8%Net provisions (4.2) (2.3) 1.9 82.6%Net profit (before appropriations) 25.7 23.3 2.4 10.2%