BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

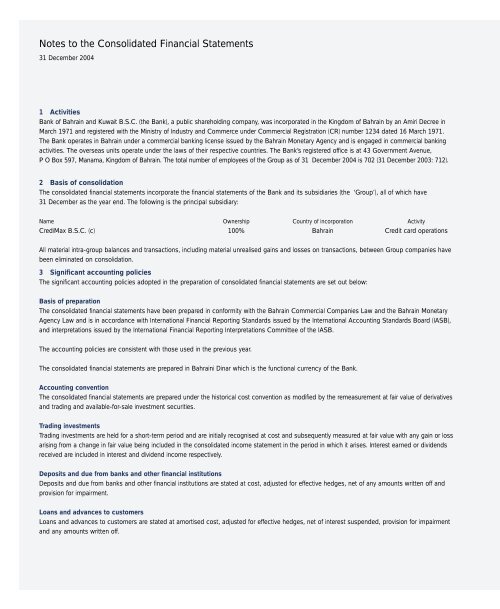

Notes to the Consolidated Financial Statements31 December 20041 ActivitiesBank of Bahrain and Kuwait B.S.C. (the Bank), a public shareholding company, was incorporated in the Kingdom of Bahrain by an Amiri Decree inMarch 1971 and registered with the Ministry of Industry and Commerce under Commercial Registration (CR) number 1234 dated 16 March 1971.The Bank operates in Bahrain under a commercial banking license issued by the Bahrain Monetary Agency and is <strong>eng</strong>aged in commercial bankingactivities. The overseas units operate under the laws of their respective countries. The Bank’s registered office is at 43 Government Avenue,P O Box 597, Manama, Kingdom of Bahrain. The total number of employees of the Group as of 31 December 2004 is 702 (31 December 2003: 712).2 Basis of consolidationThe consolidated financial statements incorporate the financial statements of the Bank and its subsidiaries (the ‘Group’), all of which have31 December as the year end. The following is the principal subsidiary:Name Ownership Country of incorporation ActivityCrediMax B.S.C. (c) 100% Bahrain Credit card operationsAll material intra-group balances and transactions, including material unrealised gains and losses on transactions, between Group companies havebeen eliminated on consolidation.3 Significant accounting policiesThe significant accounting policies adopted in the preparation of consolidated financial statements are set out below:Basis of preparationThe consolidated financial statements have been prepared in conformity with the Bahrain Commercial Companies Law and the Bahrain MonetaryAgency Law and is in accordance with International Financial Reporting Standards issued by the International Accounting Standards Board (IASB),and interpretations issued by the International Financial Reporting Interpretations Committee of the IASB.The accounting policies are consistent with those used in the previous year.The consolidated financial statements are prepared in Bahraini Dinar which is the functional currency of the Bank.Accounting conventionThe consolidated financial statements are prepared under the historical cost convention as modified by the remeasurement at fair value of derivativesand trading and available-for-sale investment securities.Trading investmentsTrading investments are held for a short-term period and are initially recognised at cost and subsequently measured at fair value with any gain or lossarising from a change in fair value being included in the consolidated income statement in the period in which it arises. Interest earned or dividendsreceived are included in interest and dividend income respectively.Deposits and due from banks and other financial institutionsDeposits and due from banks and other financial institutions are stated at cost, adjusted for effective hedges, net of any amounts written off andprovision for impairment.Loans and advances to customersLoans and advances to customers are stated at amortised cost, adjusted for effective hedges, net of interest suspended, provision for impairmentand any amounts written off.