BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

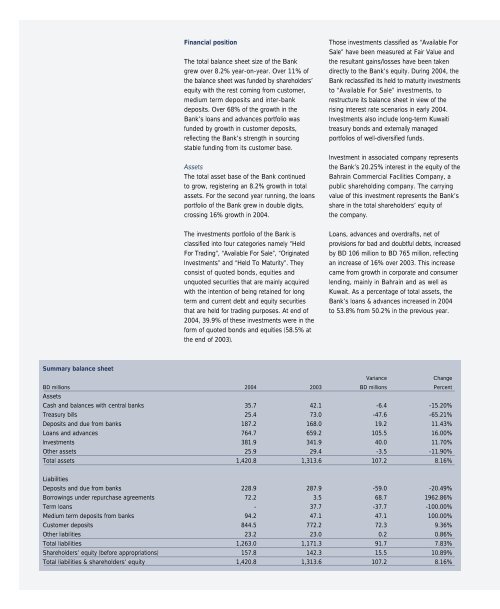

Financial positionThe total balance sheet size of the Bankgrew over 8.2% year-on-year. Over 11% ofthe balance sheet was funded by shareholders’equity with the rest coming from customer,medium term deposits and inter-bankdeposits. Over 68% of the growth in theBank’s loans and advances portfolio wasfunded by growth in customer deposits,reflecting the Bank’s str<strong>eng</strong>th in sourcingstable funding from its customer base.AssetsThe total asset base of the Bank continuedto grow, registering an 8.2% growth in totalassets. For the second year running, the loansportfolio of the Bank grew in double digits,crossing 16% growth in 2004.Those investments classified as “Available ForSale” have been measured at Fair Value andthe resultant gains/losses have been takendirectly to the Bank’s equity. During 2004, theBank reclassified its held to maturity investmentsto “Available For Sale” investments, torestructure its balance sheet in view of therising interest rate scenarios in early 2004.Investments also include long-term Kuwaititreasury bonds and externally managedportfolios of well-diversified funds.Investment in associated company representsthe Bank’s 20.25% interest in the equity of theBahrain Commercial Facilities Company, apublic shareholding company. The carryingvalue of this investment represents the Bank’sshare in the total shareholders’ equity ofthe company.The investments portfolio of the Bank isclassified into four categories namely “HeldFor Trading”, “Available For Sale”, “OriginatedInvestments” and “Held To Maturity”. Theyconsist of quoted bonds, equities andunquoted securities that are mainly acquiredwith the intention of being retained for longterm and current debt and equity securitiesthat are held for trading purposes. At end of2004, 39.9% of these investments were in theform of quoted bonds and equities (58.5% atthe end of 2003).Loans, advances and overdrafts, net ofprovisions for bad and doubtful debts, increasedby BD 106 million to BD 765 million, reflectingan increase of 16% over 2003. This increasecame from growth in corporate and consumerlending, mainly in Bahrain and as well asKuwait. As a percentage of total assets, theBank’s loans & advances increased in 2004to 53.8% from 50.2% in the previous year.Summary balance sheetVarianceChangeBD millions 2004 2003 BD millions PercentAssetsCash and balances with central banks 35.7 42.1 -6.4 -15.20%Treasury bills 25.4 73.0 -47.6 -65.21%Deposits and due from banks 187.2 168.0 19.2 11.43%Loans and advances 764.7 659.2 105.5 16.00%Investments 381.9 341.9 40.0 11.70%Other assets 25.9 29.4 -3.5 -11.90%Total assets 1,420.8 1,313.6 107.2 8.16%LiabilitiesDeposits and due from banks 228.9 287.9 -59.0 -20.49%Borrowings under repurchase agreements 72.2 3.5 68.7 1962.86%Term loans - 37.7 -37.7 -100.00%Medium term deposits from banks 94.2 47.1 47.1 100.00%Customer deposits 844.5 772.2 72.3 9.36%Other liabilities 23.2 23.0 0.2 0.86%Total liabilities 1,263.0 1,171.3 91.7 7.83%Shareholders’ equity (before appropriations) 157.8 142.3 15.5 10.89%Total liabilities & shareholders’ equity 1,420.8 1,313.6 107.2 8.16%