BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

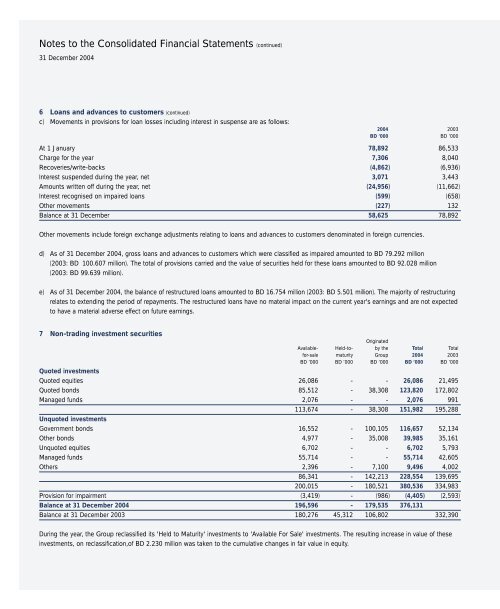

Notes to the Consolidated Financial Statements (continued)31 December 20046 Loans and advances to customers (continued)c) Movements in provisions for loan losses including interest in suspense are as follows:2004 2003BD ’000 BD ’000At 1 January 78,892 86,533Charge for the year 7,306 8,040Recoveries/write-backs (4,862) (6,936)Interest suspended during the year, net 3,071 3,443Amounts written off during the year, net (24,956) (11,662)Interest recognised on impaired loans (599) (658)Other movements (227) 132Balance at 31 December 58,625 78,892Other movements include foreign exchange adjustments relating to loans and advances to customers denominated in foreign currencies.d) As of 31 December 2004, gross loans and advances to customers which were classified as impaired amounted to BD 79.292 million(2003: BD 100.607 million). The total of provisions carried and the value of securities held for these loans amounted to BD 92.028 million(2003: BD 99.639 million).e) As of 31 December 2004, the balance of restructured loans amounted to BD 16.754 million (2003: BD 5.501 million). The majority of restructuringrelates to extending the period of repayments. The restructured loans have no material impact on the current year's earnings and are not expectedto have a material adverse effect on future earnings.7 Non-trading investment securitiesOriginatedAvailable- Held-to- by the Total Totalfor-sale maturity Group 2004 2003BD ’000 BD ’000 BD ‘000 BD ’000 BD ’000Quoted investmentsQuoted equities 26,086 - - 26,086 21,495Quoted bonds 85,512 - 38,308 123,820 172,802Managed funds 2,076 - - 2,076 991113,674 - 38,308 151,982 195,288Unquoted investmentsGovernment bonds 16,552 - 100,105 116,657 52,134Other bonds 4,977 - 35,008 39,985 35,161Unquoted equities 6,702 - - 6,702 5,793Managed funds 55,714 - - 55,714 42,605Others 2,396 - 7,100 9,496 4,00286,341 - 142,213 228,554 139,695200,015 - 180,521 380,536 334,983Provision for impairment (3,419) - (986) (4,405) (2,593)Balance at 31 December 2004 196,596 - 179,535 376,131Balance at 31 December 2003 180,276 45,312 106,802 332,390During the year, the Group reclassified its 'Held to Maturity' investments to 'Available For Sale' investments. The resulting increase in value of theseinvestments, on reclassification,of BD 2.230 million was taken to the cumulative changes in fair value in equity.