BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

BBK annual report eng 21.5.5

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

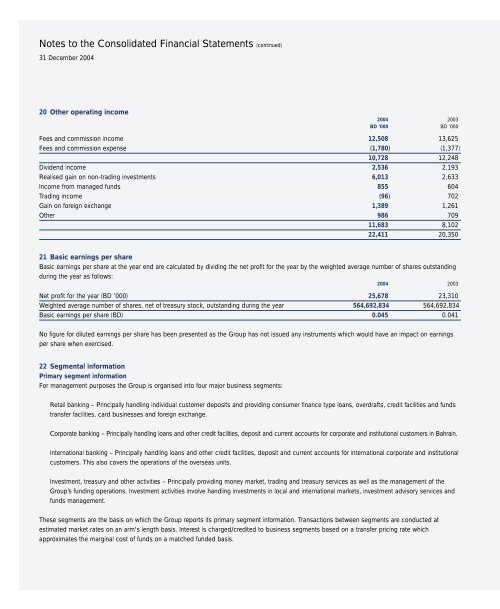

Notes to the Consolidated Financial Statements (continued)31 December 200420 Other operating income2004 2003BD ’000 BD ’000Fees and commission income 12,508 13,625Fees and commission expense (1,780) (1,377)10,728 12,248Dividend income 2,536 2,193Realised gain on non-trading investments 6,013 2,633Income from managed funds 855 604Trading income (96) 702Gain on foreign exchange 1,389 1,261Other 986 70911,683 8,10222,411 20,35021 Basic earnings per shareBasic earnings per share at the year end are calculated by dividing the net profit for the year by the weighted average number of shares outstandingduring the year as follows:2004 2003Net profit for the year (BD ’000) 25,678 23,310Weighted average number of shares, net of treasury stock, outstanding during the year 564,692,834 564,692,834Basic earnings per share (BD) 0.045 0.041No figure for diluted earnings per share has been presented as the Group has not issued any instruments which would have an impact on earningsper share when exercised.22 Segmental informationPrimary segment informationFor management purposes the Group is organised into four major business segments:Retail banking – Principally handling individual customer deposits and providing consumer finance type loans, overdrafts, credit facilities and fundstransfer facilities, card businesses and foreign exchange.Corporate banking – Principally handling loans and other credit facilities, deposit and current accounts for corporate and institutional customers in Bahrain.International banking – Principally handling loans and other credit facilities, deposit and current accounts for international corporate and institutionalcustomers. This also covers the operations of the overseas units.Investment, treasury and other activities – Principally providing money market, trading and treasury services as well as the management of theGroup’s funding operations. Investment activities involve handling investments in local and international markets, investment advisory services andfunds management.These segments are the basis on which the Group <strong>report</strong>s its primary segment information. Transactions between segments are conducted atestimated market rates on an arm's l<strong>eng</strong>th basis. Interest is charged/credited to business segments based on a transfer pricing rate whichapproximates the marginal cost of funds on a matched funded basis.