BBK Annual Report 2011

BBK Annual Report 2011

BBK Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

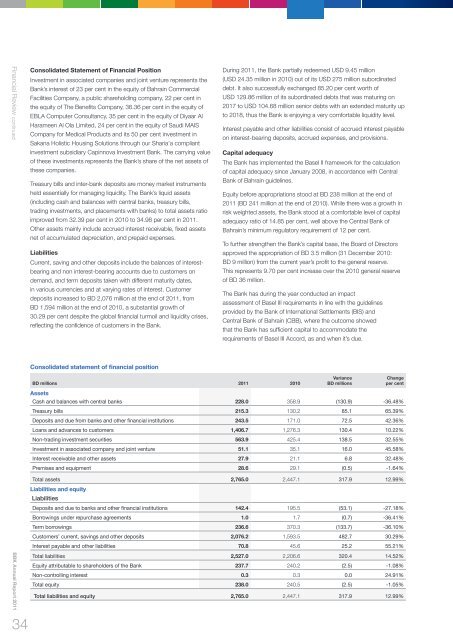

Financial Review continuedConsolidated Statement of Financial PositionInvestment in associated companies and joint venture represents theBank’s interest of 23 per cent in the equity of Bahrain CommercialFacilities Company, a public shareholding company, 22 per cent inthe equity of The Benefits Company, 36.36 per cent in the equity ofEBLA Computer Consultancy, 35 per cent in the equity of Diyaar AlHarameen Al Ola Limited, 24 per cent in the equity of Saudi MAISCompany for Medical Products and its 50 per cent investment inSakana Holistic Housing Solutions through our Sharia’a compliantinvestment subsidiary Capinnova Investment Bank. The carrying valueof these investments represents the Bank’s share of the net assets ofthese companies.Treasury bills and inter-bank deposits are money market instrumentsheld essentially for managing liquidity. The Bank’s liquid assets(including cash and balances with central banks, treasury bills,trading investments, and placements with banks) to total assets ratioimproved from 32.39 per cent in 2010 to 34.98 per cent in <strong>2011</strong>.Other assets mainly include accrued interest receivable, fixed assetsnet of accumulated depreciation, and prepaid expenses.LiabilitiesCurrent, saving and other deposits include the balances of interestbearingand non interest-bearing accounts due to customers ondemand, and term deposits taken with different maturity dates,in various currencies and at varying rates of interest. Customerdeposits increased to BD 2,076 million at the end of <strong>2011</strong>, fromBD 1,594 million at the end of 2010, a substantial growth of30.29 per cent despite the global financial turmoil and liquidity crises,reflecting the confidence of customers in the Bank.During <strong>2011</strong>, the Bank partially redeemed USD 9.45 million(USD 24.35 million in 2010) out of its USD 275 million subordinateddebt. It also successfully exchanged 85.20 per cent worth ofUSD 129.86 million of its subordinated debts that was maturing on2017 to USD 104.68 million senior debts with an extended maturity upto 2018, thus the Bank is enjoying a very comfortable liquidity level.Interest payable and other liabilities consist of accrued interest payableon interest-bearing deposits, accrued expenses, and provisions.Capital adequacyThe Bank has implemented the Basel II framework for the calculationof capital adequacy since January 2008, in accordance with CentralBank of Bahrain guidelines.Equity before appropriations stood at BD 238 million at the end of<strong>2011</strong> (BD 241 million at the end of 2010). While there was a growth inrisk weighted assets, the Bank stood at a comfortable level of capitaladequacy ratio of 14.85 per cent, well above the Central Bank ofBahrain’s minimum regulatory requirement of 12 per cent.To further strengthen the Bank’s capital base, the Board of Directorsapproved the appropriation of BD 3.5 million (31 December 2010:BD 9 million) from the current year’s profit to the general reserve.This represents 9.70 per cent increase over the 2010 general reserveof BD 36 million.The Bank has during the year conducted an impactassessment of Basel III requirements in line with the guidelinesprovided by the Bank of International Settlements (BIS) andCentral Bank of Bahrain (CBB), where the outcome showedthat the Bank has sufficient capital to accommodate therequirements of Basel III Accord, as and when it’s due.Consolidated statement of financial positionBD millions <strong>2011</strong> 2010AssetsVarianceBD millionsChangeper centCash and balances with central banks 228.0 358.9 (130.9) -36.48%Treasury bills 215.3 130.2 85.1 65.39%Deposits and due from banks and other financial institutions 243.5 171.0 72.5 42.36%Loans and advances to customers 1,406.7 1,276.3 130.4 10.22%Non-trading investment securities 563.9 425.4 138.5 32.55%Investment in associated company and joint venture 51.1 35.1 16.0 45.58%Interest receivable and other assets 27.9 21.1 6.8 32.48%Premises and equipment 28.6 29.1 (0.5) -1.64%Total assets 2,765.0 2,447.1 317.9 12.99%<strong>BBK</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>34Liabilities and equityLiabilitiesDeposits and due to banks and other financial institutions 142.4 195.5 (53.1) -27.18%Borrowings under repurchase agreements 1.0 1.7 (0.7) -36.41%Term borrowings 236.6 370.3 (133.7) -36.10%Customers’ current, savings and other deposits 2,076.2 1,593.5 482.7 30.29%Interest payable and other liabilities 70.8 45.6 25.2 55.21%Total liabilities 2,527.0 2,206.6 320.4 14.52%Equity attributable to shareholders of the Bank 237.7 240.2 (2.5) -1.08%Non-controlling interest 0.3 0.3 0.0 24.91%Total equity 238.0 240.5 (2.5) -1.05%Total liabilities and equity 2,765.0 2,447.1 317.9 12.99%