BBK Annual Report 2011

BBK Annual Report 2011

BBK Annual Report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

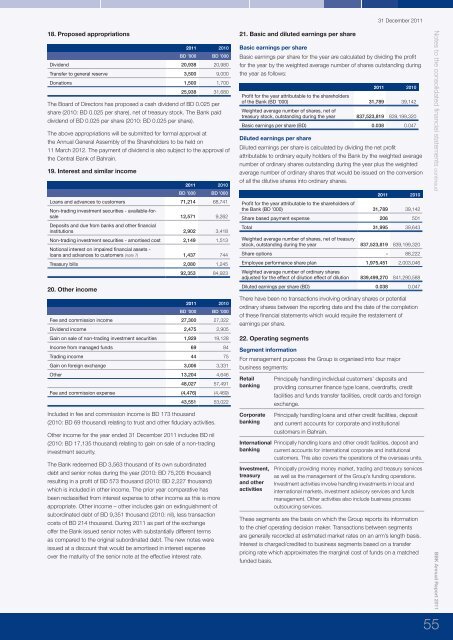

31 December <strong>2011</strong>18. Proposed appropriations<strong>2011</strong> 2010BD ’000 BD ’000Dividend 20,938 20,980Transfer to general reserve 3,500 9,000Donations 1,500 1,70025,938 31,680The Board of Directors has proposed a cash dividend of BD 0.025 pershare (2010: BD 0.025 per share), net of treasury stock. The Bank paiddividend of BD 0.025 per share (2010: BD 0.025 per share).The above appropriations will be submitted for formal approval atthe <strong>Annual</strong> General Assembly of the Shareholders to be held on11 March 2012. The payment of dividend is also subject to the approval ofthe Central Bank of Bahrain.19. Interest and similar income<strong>2011</strong> 2010BD ’000 BD ’000Loans and advances to customers 71,214 68,741Non-trading investment securities - available-forsale12,571 9,262Deposits and due from banks and other financialinstitutions 2,902 3,418Non-trading investment securities - amortised cost 2,149 1,513Notional interest on impaired financial assets -loans and advances to customers (note 7) 1,437 744Treasury bills 2,080 1,24520. Other income92,353 84,923<strong>2011</strong> 2010BD ’000 BD ’000Fee and commission income 27,300 27,322Dividend income 2,475 2,905Gain on sale of non-trading investment securities 1,929 19,128Income from managed funds 69 84Trading income 44 75Gain on foreign exchange 3,006 3,331Other 13,204 4,64648,027 57,491Fee and commission expense (4,476) (4,469)43,551 53,022Included in fee and commission income is BD 173 thousand(2010: BD 69 thousand) relating to trust and other fiduciary activities.Other income for the year ended 31 December <strong>2011</strong> includes BD nil(2010: BD 17,135 thousand) relating to gain on sale of a non-tradinginvestment security.The Bank redeemed BD 3,563 thousand of its own subordinateddebt and senior notes during the year (2010: BD 75,205 thousand)resulting in a profit of BD 573 thousand (2010: BD 2,227 thousand)which is included in other income. The prior year comparative hasbeen reclassified from interest expense to other income as this is moreappropriate. Other income – other includes gain on extinguishment ofsubordinated debt of BD 9,351 thousand (2010: nil), less transactioncosts of BD 214 thousand. During <strong>2011</strong> as part of the exchangeoffer the Bank issued senior notes with substantially different termsas compared to the original subordinated debt. The new notes wereissued at a discount that would be amortised in interest expenseover the maturity of the senior note at the effective interest rate.21. Basic and diluted earnings per shareBasic earnings per shareBasic earnings per share for the year are calculated by dividing the profitfor the year by the weighted average number of shares outstanding duringthe year as follows:<strong>2011</strong> 2010Profit for the year attributable to the shareholdersof the Bank (BD ’000) 31,789 39,142Weighted average number of shares, net oftreasury stock, outstanding during the year 837,523,819 839,199,320Basic earnings per share (BD) 0.038 0.047Diluted earnings per shareDiluted earnings per share is calculated by dividing the net profitattributable to ordinary equity holders of the Bank by the weighted averagenumber of ordinary shares outstanding during the year plus the weightedaverage number of ordinary shares that would be issued on the conversionof all the dilutive shares into ordinary shares.<strong>2011</strong> 2010Profit for the year attributable to the shareholders ofthe Bank (BD ’000) 31,789 39,142Share based payment expense 206 501Total 31,995 39,643Weighted average number of shares, net of treasurystock, outstanding during the year 837,523,819 839,199,320Share options - 88,222Employee performance share plan 1,975,451 2,003,046Weighted average number of ordinary sharesadjusted for the effect of dilution effect of dilution 839,499,270 841,290,588Diluted earnings per share (BD) 0.038 0.047There have been no transactions involving ordinary shares or potentialordinary shares between the reporting date and the date of the completionof these financial statements which would require the restatement ofearnings per share.22. Operating segmentsSegment informationFor management purposes the Group is organised into four majorbusiness segments:RetailbankingCorporatebankingInternationalbankingInvestment,treasuryand otheractivitiesPrincipally handling individual customers’ deposits andproviding consumer finance type loans, overdrafts, creditfacilities and funds transfer facilities, credit cards and foreignexchange.Principally handling loans and other credit facilities, depositand current accounts for corporate and institutionalcustomers in Bahrain.Principally handling loans and other credit facilities, deposit andcurrent accounts for international corporate and institutionalcustomers. This also covers the operations of the overseas units.Principally providing money market, trading and treasury servicesas well as the management of the Group’s funding operations.Investment activities involve handling investments in local andinternational markets, investment advisory services and fundsmanagement. Other activities also include business processoutsourcing services.These segments are the basis on which the Group reports its informationto the chief operating decision maker. Transactions between segmentsare generally recorded at estimated market rates on an arm’s length basis.Interest is charged/credited to business segments based on a transferpricing rate which approximates the marginal cost of funds on a matchedfunded basis.Notes to the consolidated financial statements contineud<strong>BBK</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>55