BBK Annual Report 2011

BBK Annual Report 2011

BBK Annual Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

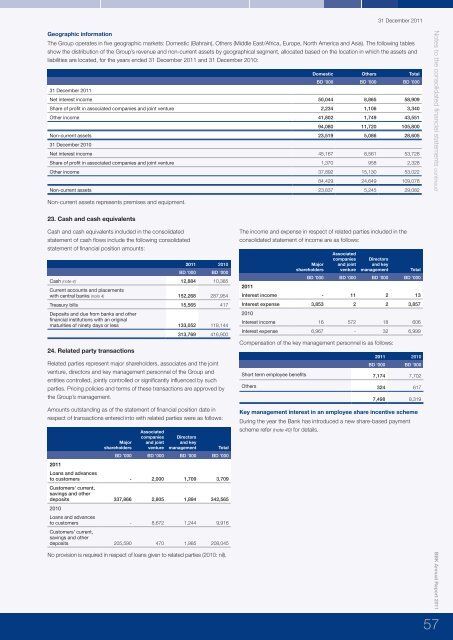

31 December <strong>2011</strong>Geographic informationThe Group operates in five geographic markets: Domestic (Bahrain), Others (Middle East/Africa, Europe, North America and Asia). The following tablesshow the distribution of the Group’s revenue and non-current assets by geographical segment, allocated based on the location in which the assets andliabilities are located, for the years ended 31 December <strong>2011</strong> and 31 December 2010:31 December <strong>2011</strong>Domestic Others TotalBD ’000 BD ’000 BD ’000Net interest income 50,044 8,865 58,909Share of profit in associated companies and joint venture 2,234 1,106 3,340Other income 41,802 1,749 43,55194,080 11,720 105,800Non-current assets 23,519 5,086 28,60531 December 2010Net interest income 45,167 8,561 53,728Share of profit in associated companies and joint venture 1,370 958 2,328Other income 37,892 15,130 53,02284,429 24,649 109,078Non-current assets 23,837 5,245 29,082Notes to the consolidated financial statements contineudNon-current assets represents premises and equipment.23. Cash and cash equivalentsCash and cash equivalents included in the consolidatedstatement of cash flows include the following consolidatedstatement of financial position amounts:<strong>2011</strong> 2010BD ’000 BD ’000Cash (note 4) 12,884 10,385Current accounts and placementswith central banks (note 4) 152,268 287,954Treasury bills 15,565 417Deposits and due from banks and otherfinancial institutions with an originalmaturities of ninety days or less 133,052 118,14424. Related party transactions313,769 416,900Related parties represent major shareholders, associates and the jointventure, directors and key management personnel of the Group andentities controlled, jointly controlled or significantly influenced by suchparties. Pricing policies and terms of these transactions are approved bythe Group’s management.Amounts outstanding as of the statement of financial position date inrespect of transactions entered into with related parties were as follows:<strong>2011</strong>MajorshareholdersAssociatedcompaniesand jointventureDirectorsand keymanagementTotalBD ’000 BD ’000 BD ’000 BD ’000Loans and advancesto customers - 2,000 1,709 3,709Customers’ current,savings and otherdeposits 337,866 2,805 1,894 342,5652010Loans and advancesto customers - 8,672 1,244 9,916Customers’ current,savings and otherdeposits 205,590 470 1,985 208,045The income and expense in respect of related parties included in theconsolidated statement of income are as follows:<strong>2011</strong>MajorshareholdersAssociatedcompaniesand jointventureDirectorsand keymanagementTotalBD ’000 BD ’000 BD ’000 BD ’000Interest income - 11 2 13Interest expense 3,853 2 2 3,8572010Interest income 16 572 18 606Interest expense 6,967 - 32 6,999Compensation of the key management personnel is as follows:<strong>2011</strong> 2010BD ’000 BD ’000Short term employee benefits 7,174 7,702Others 324 6177,498 8,319Key management interest in an employee share incentive schemeDuring the year the Bank has introduced a new share-based paymentscheme refer (note 40) for details.No provision is required in respect of loans given to related parties (2010: nil).<strong>BBK</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>57