BBK Annual Report 2011

BBK Annual Report 2011

BBK Annual Report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

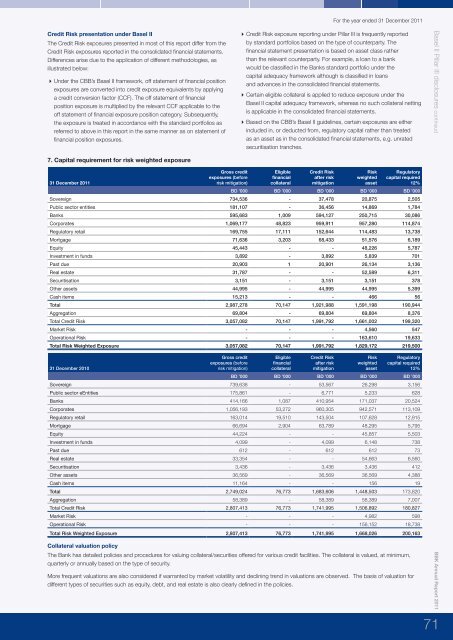

Credit Risk presentation under Basel IIThe Credit Risk exposures presented in most of this report differ from theCredit Risk exposures reported in the consolidated financial statements.Differences arise due to the application of different methodologies, asillustrated below:Under the CBB’s Basel II framework, off statement of financial positionexposures are converted into credit exposure equivalents by applyinga credit conversion factor (CCF). The off statement of financialposition exposure is multiplied by the relevant CCF applicable to theoff statement of financial exposure position category. Subsequently,the exposure is treated in accordance with the standard portfolios asreferred to above in this report in the same manner as on statement offinancial position exposures.7. Capital requirement for risk weighted exposureFor the year ended 31 December <strong>2011</strong>Credit Risk exposure reporting under Pillar III is frequently reportedby standard portfolios based on the type of counterparty. Thefinancial statement presentation is based on asset class ratherthan the relevant counterparty. For example, a loan to a bankwould be classified in the Banks standard portfolio under thecapital adequacy framework although is classified in loansand advances in the consolidated financial statements.Certain eligible collateral is applied to reduce exposure under theBasel II capital adequacy framework, whereas no such collateral nettingis applicable in the consolidated financial statements.Based on the CBB’s Basel II guidelines, certain exposures are eitherincluded in, or deducted from, regulatory capital rather than treatedas an asset as in the consolidated financial statements, e.g. unratedsecuritisation tranches.Basel II Pillar III disclosures contineud31 December <strong>2011</strong>Gross creditexposures (beforerisk mitigation)EligiblefinancialcollateralCredit Riskafter riskmitigationRiskweightedassetRegulatorycapital required12%BD ’000 BD ’000 BD ’000 BD ’000 BD ’000Sovereign 734,536 - 37,478 20,875 2,505Public sector entities 181,107 - 36,456 14,869 1,784Banks 595,683 1,009 594,127 250,715 30,086Corporates 1,069,177 48,823 959,911 957,280 114,874Regulatory retail 169,755 17,111 152,644 114,483 13,738Mortgage 71,636 3,203 68,433 51,576 6,189Equity 45,443 - - 48,226 5,787Investment in funds 3,892 - 3,892 5,839 701Past due 20,903 1 20,901 26,134 3,136Real estate 31,787 - - 52,589 6,311Securitisation 3,151 - 3,151 3,151 378Other assets 44,995 - 44,995 44,995 5,399Cash items 15,213 - - 466 56Total 2,987,278 70,147 1,921,988 1,591,198 190,944Aggregation 69,804 - 69,804 69,804 8,376Total Credit Risk 3,057,082 70,147 1,991,792 1,661,002 199,320Market Risk - - - 4,560 547Operational Risk - - - 163,610 19,633Total Risk Weighted Exposure 3,057,082 70,147 1,991,792 1,829,172 219,50031 December 2010Gross creditexposures (beforerisk mitigation)EligiblefinancialcollateralCredit Riskafter riskmitigationRiskweightedassetRegulatorycapital required12%BD ’000 BD ’000 BD ’000 BD ’000 BD ’000Sovereign 739,638 - 53,567 26,298 3,156Public sector eEntities 175,861 - 6,771 5,233 628Banks 414,166 1,087 410,954 171,037 20,524Corporates 1,056,193 53,272 960,305 942,571 113,109Regulatory retail 163,014 19,510 143,504 107,628 12,915Mortgage 66,694 2,904 63,789 48,295 5,795Equity 44,224 - - 45,857 5,503Investment in funds 4,099 - 4,099 6,148 738Past due 612 - 612 612 73Real estate 33,354 - - 54,663 6,560Securitisation 3,436 - 3,436 3,436 412Other assets 36,569 - 36,569 36,569 4,388Cash items 11,164 - - 156 19Total 2,749,024 76,773 1,683,606 1,448,503 173,820Aggregation 58,389 - 58,389 58,389 7,007Total Credit Risk 2,807,413 76,773 1,741,995 1,506,892 180,827Market Risk - - - 4,982 598Operational Risk - - - 156,152 18,738Total Risk Weighted Exposure 2,807,413 76,773 1,741,995 1,668,026 200,163Collateral valuation policyThe Bank has detailed policies and procedures for valuing collateral/securities offered for various credit facilities. The collateral is valued, at minimum,quarterly or annually based on the type of security.More frequent valuations are also considered if warranted by market volatility and declining trend in valuations are observed. The basis of valuation fordifferent types of securities such as equity, debt, and real estate is also clearly defined in the policies.<strong>BBK</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>71