BBK Annual Report 2011

BBK Annual Report 2011

BBK Annual Report 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

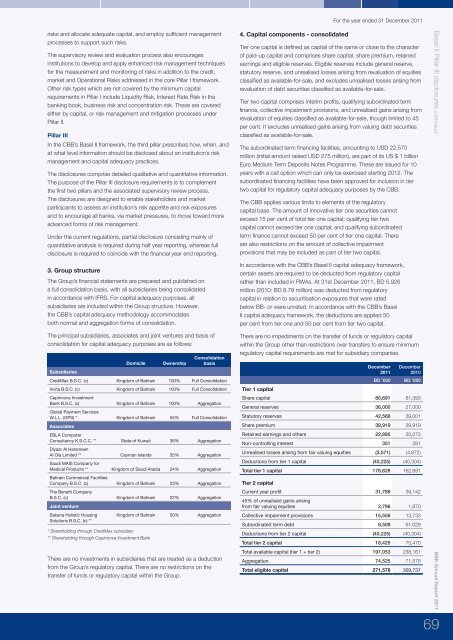

isks and allocate adequate capital, and employ sufficient managementprocesses to support such risks.The supervisory review and evaluation process also encouragesinstitutions to develop and apply enhanced risk management techniquesfor the measurement and monitoring of risks in addition to the credit,market and Operational Risks addressed in the core Pillar I framework.Other risk types which are not covered by the minimum capitalrequirements in Pillar I include Liquidity Risk, Interest Rate Risk in thebanking book, business risk and concentration risk. These are coveredeither by capital, or risk management and mitigation processes underPillar II.Pillar IIIIn the CBB’s Basel II framework, the third pillar prescribes how, when, andat what level information should be disclosed about an institution’s riskmanagement and capital adequacy practices.The disclosures comprise detailed qualitative and quantitative information.The purpose of the Pillar III disclosure requirements is to complementthe first two pillars and the associated supervisory review process.The disclosures are designed to enable stakeholders and marketparticipants to assess an institution’s risk appetite and risk exposuresand to encourage all banks, via market pressures, to move toward moreadvanced forms of risk management.Under the current regulations, partial disclosure consisting mainly ofquantitative analysis is required during half year reporting, whereas fulldisclosure is required to coincide with the financial year end reporting.3. Group structureThe Group’s financial statements are prepared and published ona full consolidation basis, with all subsidiaries being consolidatedin accordance with IFRS. For capital adequacy purposes, allsubsidiaries are included within the Group structure. However,the CBB’s capital adequacy methodology accommodatesboth normal and aggregation forms of consolidation.4. Capital components - consolidatedFor the year ended 31 December <strong>2011</strong>Tier one capital is defined as capital of the same or close to the characterof paid-up capital and comprises share capital, share premium, retainedearnings and eligible reserves. Eligible reserves include general reserve,statutory reserve, and unrealised losses arising from revaluation of equitiesclassified as available-for-sale, and excludes unrealised losses arising fromrevaluation of debt securities classified as available-for-sale.Tier two capital comprises interim profits, qualifying subordinated termfinance, collective impairment provisions, and unrealised gains arising fromrevaluation of equities classified as available-for-sale, though limited to 45per cent. It excludes unrealised gains arising from valuing debt securitiesclassified as available-for-sale.The subordinated term financing facilities, amounting to USD 22.570million (initial amount raised USD 275 million), are part of its US $ 1 billionEuro Medium Term Deposits Notes Programme. These are issued for 10years with a call option which can only be exercised starting 2012. Thesubordinated financing facilities have been approved for inclusion in tiertwo capital for regulatory capital adequacy purposes by the CBB.The CBB applies various limits to elements of the regulatorycapital base. The amount of innovative tier one securities cannotexceed 15 per cent of total tier one capital; qualifying tier twocapital cannot exceed tier one capital; and qualifying subordinatedterm finance cannot exceed 50 per cent of tier one capital. Thereare also restrictions on the amount of collective impairmentprovisions that may be included as part of tier two capital.In accordance with the CBB’s Basel II capital adequacy framework,certain assets are required to be deducted from regulatory capitalrather than included in RWAs. At 31st December <strong>2011</strong>, BD 5.926million (2010: BD 8.79 million) was deducted from regulatorycapital in relation to securitisation exposures that were ratedbelow BB- or were unrated. In accordance with the CBB’s BaselII capital adequacy framework, the deductions are applied 50per cent from tier one and 50 per cent from tier two capital.Basel II Pillar III disclosures contineudThe principal subsidiaries, associates and joint ventures and basis ofconsolidation for capital adequacy purposes are as follows:SubsidiariesDomicileOwnershipConsolidationbasisCrediMax B.S.C. (c) Kingdom of Bahrain 100% Full ConsolidationInvita B.S.C. (c) Kingdom of Bahrain 100% Full ConsolidationCapinnova InvestmentBank B.S.C. (c) Kingdom of Bahrain 100% AggregationGlobal Payment ServicesW.L.L. (GPS) * Kingdom of Bahrain 55% Full ConsolidationAssociatesEBLA ComputerConsultancy K.S.C.C. ** State of Kuwait 36% AggregationDiyaar Al HarameenAl Ola Limited ** Cayman Islands 35% AggregationSaudi MAIS Company forMedical Products ** Kingdom of Saudi Arabia 24% AggregationBahrain Commercial FacilitiesCompany B.S.C. (c) Kingdom of Bahrain 23% AggregationThe Benefit CompanyB.S.C. (c) Kingdom of Bahrain 22% AggregationJoint ventureSakana Holistic HousingSolutions B.S.C. (c) *** Shareholding through CrediMax subsidiary** Shareholding through Capinnova Investment BankKingdom of Bahrain 50% AggregationThere are no investments in subsidiaries that are treated as a deductionfrom the Group’s regulatory capital. There are no restrictions on thetransfer of funds or regulatory capital within the Group.There are no impediments on the transfer of funds or regulatory capitalwithin the Group other than restrictions over transfers to ensure minimumregulatory capital requirements are met for subsidiary companies.Tier 1 capitalDecember<strong>2011</strong>December2010BD ’000 BD ’000Share capital 80,691 81,393General reserves 36,000 27,000Statutory reserves 42,568 39,001Share premium 39,919 39,919Retained earnings and others 22,895 20,273Non-controlling interest 351 281Unrealised losses arising from fair valuing equities (3,571) (4,872)Deductions from tier 1 capital (40,225) (40,304)Total tier 1 capital 178,628 162,691Tier 2 capitalCurrent year profit 31,789 39,14245% of unrealised gains arisingfrom fair valuing equities 2,796 1,870Collective impairment provisions 15,556 13,733Subordinated term debt 8,509 61,029Deductions from tier 2 capital (40,225) (40,304)Total tier 2 capital 18,425 75,470Total available capital (tier 1 + tier 2) 197,053 238,161Aggregation 74,525 71,576Total eligible capital 271,578 309,737<strong>BBK</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>69