012 - ÄEZ Distribuce

012 - ÄEZ Distribuce

012 - ÄEZ Distribuce

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ČEZ <strong>Distribuce</strong>, a. s. Notes to the Financial Statements as of December 31, 2<strong>012</strong><br />

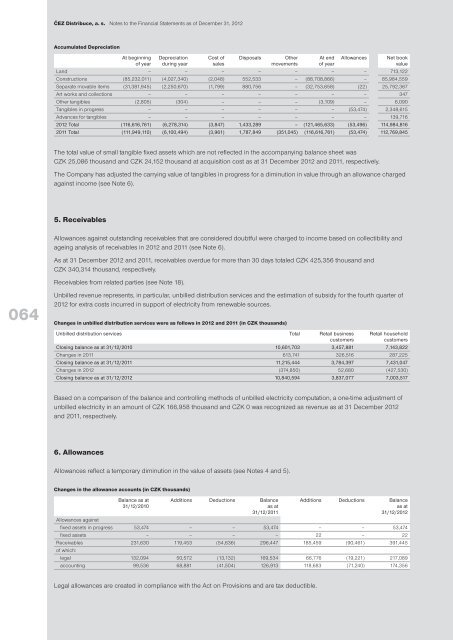

Accumulated Depreciation<br />

At beginning Depreciation Cost of Disposals Other At end Allowances Net book<br />

of year during year sales movements of year value<br />

Land – – – – – – – 713,122<br />

Constructions (85,232,011) (4,027,340) (2,048) 552,533 – (88,708,866) – 85,984,559<br />

Separate movable items (31,381,945) (2,250,670) (1,799) 880,756 – (32,753,658) (22) 25,792,367<br />

Art works and collections – – – – – – – 347<br />

Other tangibles (2,805) (304) – – – (3,109) – 6,090<br />

Tangibles in progress – – – – – – (53,474) 2,348,615<br />

Advances for tangibles – – – – – – – 139,716<br />

2<strong>012</strong> Total (116,616,761) (6,278,314) (3,847) 1,433,289 – (121,465,633) (53,496) 114,984,816<br />

2011 Total (111,949,110) (6,100,494) (3,961) 1,787,849 (351,045) (116,616,761) (53,474) 112,769,845<br />

The total value of small tangible fixed assets which are not reflected in the accompanying balance sheet was<br />

CZK 25,086 thousand and CZK 24,152 thousand at acquisition cost as at 31 December 2<strong>012</strong> and 2011, respectively.<br />

The Company has adjusted the carrying value of tangibles in progress for a diminution in value through an allowance charged<br />

against income (see Note 6).<br />

5. Receivables<br />

Allowances against outstanding receivables that are considered doubtful were charged to income based on collectibility and<br />

ageing analysis of receivables in 2<strong>012</strong> and 2011 (see Note 6).<br />

As at 31 December 2<strong>012</strong> and 2011, receivables overdue for more than 30 days totaled CZK 425,356 thousand and<br />

CZK 340,314 thousand, respectively.<br />

Receivables from related parties (see Note 18).<br />

064<br />

Unbilled revenue represents, in particular, unbilled distribution services and the estimation of subsidy for the fourth quarter of<br />

2<strong>012</strong> for extra costs incurred in support of electricity from renewable sources.<br />

Changes in unbilled distribution services were as follows in 2<strong>012</strong> and 2011 (in CZK thousands)<br />

Unbilled distribution services Total Retail business Retail household<br />

customers<br />

customers<br />

Closing balance as at 31/12/2010 10,601,703 3,457,881 7,143,822<br />

Changes in 2011 613,741 326,516 287,225<br />

Closing balance as at 31/12/2011 11,215,444 3,784,397 7,431,047<br />

Changes in 2<strong>012</strong> (374,850) 52,680 (427,530)<br />

Closing balance as at 31/12/2<strong>012</strong> 10,840,594 3,837,077 7,003,517<br />

Based on a comparison of the balance and controlling methods of unbilled electricity computation, a one-time adjustment of<br />

unbilled electricity in an amount of CZK 166,958 thousand and CZK 0 was recognized as revenue as at 31 December 2<strong>012</strong><br />

and 2011, respectively.<br />

6. Allowances<br />

Allowances reflect a temporary diminution in the value of assets (see Notes 4 and 5).<br />

Changes in the allowance accounts (in CZK thousands)<br />

Balance as at Additions Deductions Balance Additions Deductions Balance<br />

31/12/2010 as at as at<br />

31/12/2011 31/12/2<strong>012</strong><br />

Allowances against<br />

fixed assets in progress 53,474 – – 53,474 – – 53,474<br />

fixed assets – – – – 22 – 22<br />

Receivables 231,630 119,453 (54,636) 296,447 185,459 (90,461) 391,445<br />

of which:<br />

legal 132,094 50,572 (13,132) 169,534 66,776 (19,221) 217,089<br />

accounting 99,536 68,881 (41,504) 126,913 118,683 (71,240) 174,356<br />

Legal allowances are created in compliance with the Act on Provisions and are tax deductible.