012 - ÄEZ Distribuce

012 - ÄEZ Distribuce

012 - ÄEZ Distribuce

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ČEZ <strong>Distribuce</strong>, a. s. Notes to the Financial Statements as of December 31, 2<strong>012</strong><br />

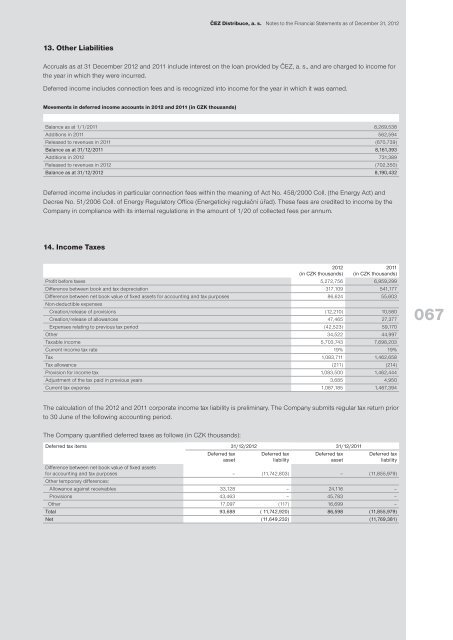

13. Other Liabilities<br />

Accruals as at 31 December 2<strong>012</strong> and 2011 include interest on the loan provided by ČEZ, a. s., and are charged to income for<br />

the year in which they were incurred.<br />

Deferred income includes connection fees and is recognized into income for the year in which it was earned.<br />

Movements in deferred income accounts in 2<strong>012</strong> and 2011 (in CZK thousands)<br />

Balance as at 1/1/2011 8,269,538<br />

Additions in 2011 562,594<br />

Released to revenues in 2011 (670,739)<br />

Balance as at 31/12/2011 8,161,393<br />

Additions in 2<strong>012</strong> 731,389<br />

Released to revenues in 2<strong>012</strong> (702,350)<br />

Balance as at 31/12/2<strong>012</strong> 8,190,432<br />

Deferred income includes in particular connection fees within the meaning of Act No. 458/2000 Coll. (the Energy Act) and<br />

Decree No. 51/2006 Coll. of Energy Regulatory Office (Energetický regulační úřad). These fees are credited to income by the<br />

Company in compliance with its internal regulations in the amount of 1/20 of collected fees per annum.<br />

14. Income Taxes<br />

2<strong>012</strong> 2011<br />

(in CZK thousands) (in CZK thousands)<br />

Profit before taxes 5,272,756 6,959,299<br />

Difference between book and tax depreciation 317,109 541,177<br />

Difference between net book value of fixed assets for accounting and tax purposes 86,624 55,603<br />

Non-deductible expenses<br />

Creation/release of provisions (12,210) 10,580<br />

Creation/release of allowances 47,465 27,377<br />

Expenses relating to previous tax period (42,523) 59,170<br />

Other 34,522 44,997<br />

Taxable income 5,703,743 7,698,203<br />

Current income tax rate 19% 19%<br />

Tax 1,083,711 1,462,658<br />

Tax allowance (211) (214)<br />

Provision for income tax 1,083,500 1,462,444<br />

Adjustment of the tax paid in previous years 3,685 4,950<br />

Current tax expense 1,087,185 1,467,394<br />

067<br />

The calculation of the 2<strong>012</strong> and 2011 corporate income tax liability is preliminary. The Company submits regular tax return prior<br />

to 30 June of the following accounting period.<br />

The Company quantified deferred taxes as follows (in CZK thousands):<br />

Deferred tax items 31/12/2<strong>012</strong> 31/12/2011<br />

Deferred tax Deferred tax Deferred tax Deferred tax<br />

asset liability asset liability<br />

Difference between net book value of fixed assets<br />

for accounting and tax purposes – (11,742,803) – (11,855,979)<br />

Other temporary differences:<br />

Allowance against receivables 33,128 – 24,116 –<br />

Provisions 43,463 – 45,783 –<br />

Other 17,097 (117) 16,699 –<br />

Total 93,688 ( 11,742,920) 86,598 (11,855,979)<br />

Net (11,649,232) (11,769,381)