Transaction Security

H017WR70

H017WR70

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

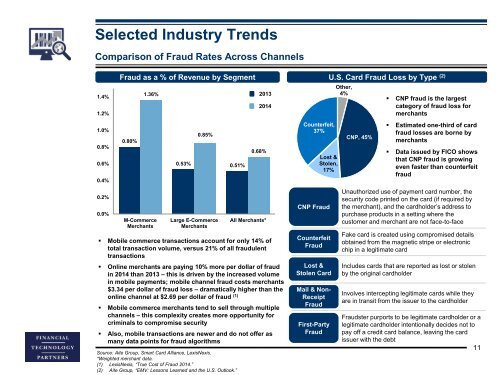

Selected Industry Trends<br />

Comparison of Fraud Rates Across Channels<br />

1.4%<br />

1.2%<br />

1.0%<br />

0.8%<br />

0.6%<br />

0.4%<br />

0.2%<br />

0.0%<br />

Fraud as a % of Revenue by Segment<br />

0.80%<br />

1.36%<br />

M-Commerce<br />

Merchants<br />

0.53%<br />

0.85%<br />

Large E-Commerce<br />

Merchants<br />

0.51%<br />

2013<br />

2014<br />

0.68%<br />

All Merchants*<br />

• Mobile commerce transactions account for only 14% of<br />

total transaction volume, versus 21% of all fraudulent<br />

transactions<br />

• Online merchants are paying 10% more per dollar of fraud<br />

in 2014 than 2013 – this is driven by the increased volume<br />

in mobile payments; mobile channel fraud costs merchants<br />

$3.34 per dollar of fraud loss – dramatically higher than the<br />

online channel at $2.69 per dollar of fraud (1)<br />

• Mobile commerce merchants tend to sell through multiple<br />

channels – this complexity creates more opportunity for<br />

criminals to compromise security<br />

• Also, mobile transactions are newer and do not offer as<br />

many data points for fraud algorithms<br />

Source: Aite Group, Smart Card Alliance, LexisNexis.<br />

*Weighted merchant data.<br />

(1) LexisNexis, “True Cost of Fraud 2014.”<br />

(2) Aite Group, “EMV: Lessons Learned and the U.S. Outlook.”<br />

Counterfeit,<br />

37%<br />

Lost &<br />

Stolen,<br />

17%<br />

CNP Fraud<br />

Counterfeit<br />

Fraud<br />

Lost Lost &<br />

Stolen<br />

Stolen Card<br />

Card Fraud<br />

Mail & Non-<br />

Receipt<br />

Fraud<br />

First-Party<br />

Fraud<br />

U.S. Card Fraud Loss by Type (2)<br />

Other,<br />

4%<br />

CNP, 45%<br />

• CNP fraud is the largest<br />

category of fraud loss for<br />

merchants<br />

• Estimated one-third of card<br />

fraud losses are borne by<br />

merchants<br />

• Data issued by FICO shows<br />

that CNP fraud is growing<br />

even faster than counterfeit<br />

fraud<br />

Unauthorized use of payment card number, the<br />

security code printed on the card (if required by<br />

the merchant), and the cardholder’s address to<br />

purchase products in a setting where the<br />

customer and merchant are not face-to-face<br />

Fake card is created using compromised details<br />

obtained from the magnetic stripe or electronic<br />

chip in a legitimate card<br />

Includes cards that are reported as lost or stolen<br />

by the original cardholder<br />

Involves intercepting legitimate cards while they<br />

are in transit from the issuer to the cardholder<br />

Fraudster purports to be legitimate cardholder or a<br />

legitimate cardholder intentionally decides not to<br />

pay off a credit card balance, leaving the card<br />

issuer with the debt<br />

11