Transaction Security

H017WR70

H017WR70

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

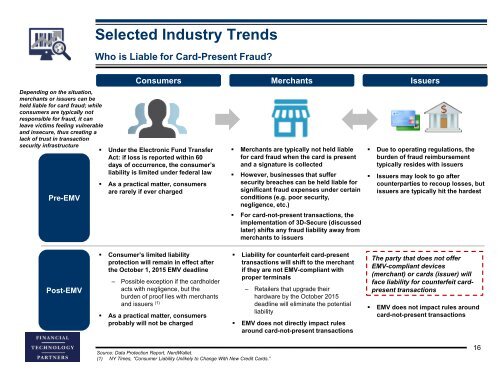

Selected Industry Trends<br />

Who is Liable for Card-Present Fraud?<br />

Consumers<br />

Depending on the situation,<br />

merchants or issuers can be<br />

held liable for card fraud; while<br />

consumers are typically not<br />

responsible for fraud, it can<br />

leave victims feeling vulnerable<br />

and insecure, thus creating a<br />

lack of trust in transaction<br />

security infrastructure<br />

• Under the Electronic Fund Transfer<br />

Act: if loss is reported within 60<br />

days of occurrence, the consumer’s<br />

liability is limited under federal law<br />

Pre-EMV<br />

• As a practical matter, consumers<br />

are rarely if ever charged<br />

Merchants<br />

• Merchants are typically not held liable<br />

for card fraud when the card is present<br />

and a signature is collected<br />

• However, businesses that suffer<br />

security breaches can be held liable for<br />

significant fraud expenses under certain<br />

conditions (e.g. poor security,<br />

negligence, etc.)<br />

• For card-not-present transactions, the<br />

implementation of 3D-Secure (discussed<br />

later) shifts any fraud liability away from<br />

merchants to issuers<br />

Issuers<br />

• Due to operating regulations, the<br />

burden of fraud reimbursement<br />

typically resides with issuers<br />

• Issuers may look to go after<br />

counterparties to recoup losses, but<br />

issuers are typically hit the hardest<br />

Post-EMV<br />

• Consumer’s limited liability<br />

protection will remain in effect after<br />

the October 1, 2015 EMV deadline<br />

‒ Possible exception if the cardholder<br />

acts with negligence, but the<br />

burden of proof lies with merchants<br />

and issuers (1)<br />

• As a practical matter, consumers<br />

probably will not be charged<br />

• Liability for counterfeit card-present<br />

transactions will shift to the merchant<br />

if they are not EMV-compliant with<br />

proper terminals<br />

‒ Retailers that upgrade their<br />

hardware by the October 2015<br />

deadline will eliminate the potential<br />

liability<br />

• EMV does not directly impact rules<br />

around card-not-present transactions<br />

The party that does not offer<br />

EMV-compliant devices<br />

(merchant) or cards (issuer) will<br />

face liability for counterfeit cardpresent<br />

transactions<br />

• EMV does not impact rules around<br />

card-not-present transactions<br />

Source: Data Protection Report, NerdWallet.<br />

(1) NY Times, “Consumer Liability Unlikely to Change With New Credit Cards.”<br />

16