Transaction Security

H017WR70

H017WR70

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Overview of <strong>Transaction</strong> <strong>Security</strong> Technology Solutions<br />

1<br />

Consumer<br />

Authentication<br />

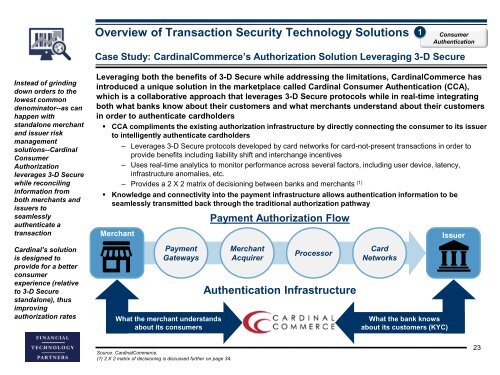

Case Study: CardinalCommerce’s Authorization Solution Leveraging 3-D Secure<br />

Instead of grinding<br />

down orders to the<br />

lowest common<br />

denominator--as can<br />

happen with<br />

standalone merchant<br />

and issuer risk<br />

management<br />

solutions--Cardinal<br />

Consumer<br />

Authorization<br />

leverages 3-D Secure<br />

while reconciling<br />

information from<br />

both merchants and<br />

issuers to<br />

seamlessly<br />

authenticate a<br />

transaction<br />

Leveraging both the benefits of 3-D Secure while addressing the limitations, CardinalCommerce has<br />

introduced a unique solution in the marketplace called Cardinal Consumer Authentication (CCA),<br />

which is a collaborative approach that leverages 3-D Secure protocols while in real-time integrating<br />

both what banks know about their customers and what merchants understand about their customers<br />

in order to authenticate cardholders<br />

• CCA compliments the existing authorization infrastructure by directly connecting the consumer to its issuer<br />

to intelligently authenticate cardholders<br />

Merchant<br />

‒ Leverages 3-D Secure protocols developed by card networks for card-not-present transactions in order to<br />

provide benefits including liability shift and interchange incentives<br />

‒ Uses real-time analytics to monitor performance across several factors, including user device, latency,<br />

infrastructure anomalies, etc.<br />

‒ Provides a 2 X 2 matrix of decisioning between banks and merchants (1)<br />

• Knowledge and connectivity into the payment infrastructure allows authentication information to be<br />

seamlessly transmitted back through the traditional authorization pathway<br />

Payment Authorization Flow<br />

Issuer<br />

Cardinal’s solution<br />

is designed to<br />

provide for a better<br />

consumer<br />

experience (relative<br />

to 3-D Secure<br />

standalone), thus<br />

improving<br />

authorization rates<br />

Payment<br />

Gateways<br />

What the merchant understands<br />

about its consumers<br />

Merchant<br />

Acquirer<br />

Processor<br />

Authentication Infrastructure<br />

Card<br />

Networks<br />

What the bank knows<br />

about its customers (KYC)<br />

Source: CardinalCommerce.<br />

(1) 2 X 2 matrix of decisioning is discussed further on page 34.<br />

23