Annual Report of ACS Group - Grupo ACS

Annual Report of ACS Group - Grupo ACS

Annual Report of ACS Group - Grupo ACS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated<br />

Financial Statements<br />

The <strong>ACS</strong> <strong>Group</strong> held mortgage loans for an amount <strong>of</strong> EUR 57,580 thousand on 31 December 2010 (EUR 15,203 thousand<br />

on 31 December 2009).<br />

At 31 December 2010, the <strong>Group</strong> companies had been granted lines <strong>of</strong> credit with limits <strong>of</strong> EUR 3,636,110 thousand (EUR<br />

3,666,296 thousand in 2009), <strong>of</strong> which the amount <strong>of</strong> EUR 1,528,887 thousand (EUR 1,687,530 thousand at 31 December<br />

2009) had not been draw upon, which suffi ciently meets any need <strong>of</strong> the <strong>Group</strong> according to the short-term existing<br />

commitments.<br />

At 31 December 2010, the current and non-current bank borrowings in foreign currency amounted to EUR 288,288 thousand<br />

(EUR 194,052 thousand in 2009), <strong>of</strong> which EUR 120,867 thousand were in US dollars (EUR 104,493 thousand in 2009), EUR<br />

42,626 thousand were in Chilean pesos (EUR 28,905 thousand in 2009), EUR 23,255 thousand were in Moroccan dirham, EUR<br />

47,744 thousand were in Brazilian reals (EUR 14,653 thousand in 2009), EUR 8,120 thousand in Polish zlotys (EUR 12,111<br />

thousand in 2009).<br />

Foreign currency loans and credits are recognised at their equivalent Euro value at each year-end, calculated at the exchange<br />

rates prevailing at 31 December.<br />

In 2010 the <strong>Group</strong>’s Euro loans and credits bore average annual interest at 2.92%, (3.32% in 2009). For the loans and credits<br />

denominated in foreign currency, the interest was 3.51% (3.76% in 2009).<br />

Following its risk management policy, the <strong>ACS</strong> <strong>Group</strong> attempts to achieve a reasonable balance between long-term fi nancing<br />

for the <strong>Group</strong>’s strategic investments (above all, project fi nancing and limited recourse fi nancing as described in Note 18)<br />

and short-term fi nancing for the management <strong>of</strong> working capital. The impact <strong>of</strong> interest rate variations on the fi nancing<br />

expense is indicated in Note 21.<br />

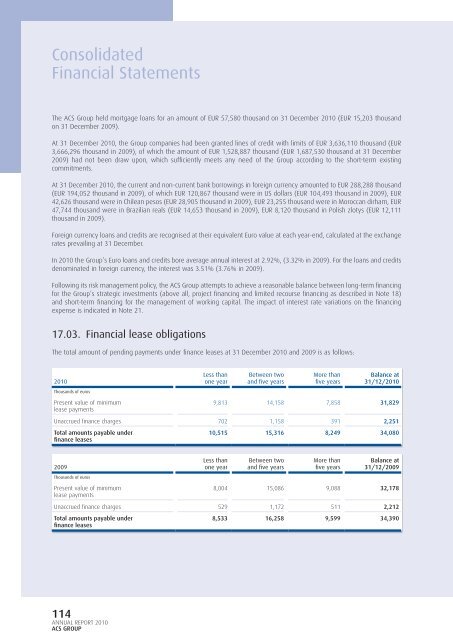

17.03. Financial lease obligations<br />

The total amount <strong>of</strong> pending payments under fi nance leases at 31 December 2010 and 2009 is as follows:<br />

2010<br />

Thousands <strong>of</strong> euros<br />

Present value <strong>of</strong> minimum<br />

lease payments<br />

114<br />

ANNUAL REPORT 2010<br />

<strong>ACS</strong> GROUP<br />

Less than<br />

one year<br />

Between two<br />

and fi ve years<br />

More than<br />

fi ve years<br />

Balance at<br />

31/12/2010<br />

9,813 14,158 7,858 31,829<br />

Unaccrued fi nance charges 702 1,158 391 2,251<br />

Total amounts payable under<br />

fi nance leases<br />

2009<br />

Thousands <strong>of</strong> euros<br />

Present value <strong>of</strong> minimum<br />

lease payments<br />

10,515 15,316 8,249 34,080<br />

Less than<br />

one year<br />

Between two<br />

and fi ve years<br />

More than<br />

fi ve years<br />

Balance at<br />

31/12/2009<br />

8,004 15,086 9,088 32,178<br />

Unaccrued fi nance charges 529 1,172 511 2,212<br />

Total amounts payable under<br />

fi nance leases<br />

8,533 16,258 9,599 34,390