Annual Report of ACS Group - Grupo ACS

Annual Report of ACS Group - Grupo ACS

Annual Report of ACS Group - Grupo ACS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated<br />

Financial Statements<br />

Said provisions are funded as the associated commitments arise, with their usage calendar being either associated with<br />

the number <strong>of</strong> tonnes treated in the case <strong>of</strong> waste treatment concessions and the progress in fi lling the different basins, or<br />

in the case <strong>of</strong> concessions <strong>of</strong> other activities, being associated with the use <strong>of</strong> infrastructure and/or wear and tear <strong>of</strong> the<br />

same. Said calendars are analysed according to the Economic/Financial Model <strong>of</strong> each concession, considering the historical<br />

information <strong>of</strong> the same for the purpose <strong>of</strong> adjusting possible deviations that could arise in the calendar included in the<br />

models there<strong>of</strong>.<br />

Provision for settlement <strong>of</strong> losses <strong>of</strong> works<br />

This pertains to the losses budgeted for construction works, as well as for the expenses arising from the same, once they<br />

are fi nished until the fi nal settlement takes place, determined systematically based upon a percentage over the production<br />

value, throughout the execution <strong>of</strong> the works, according to the experience in construction activities.<br />

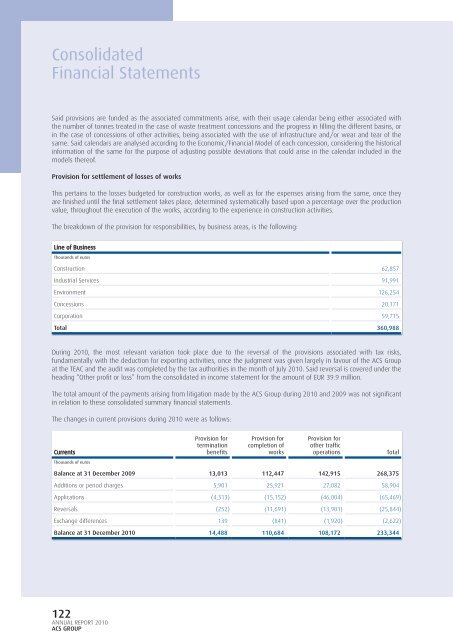

The breakdown <strong>of</strong> the provision for responsibilities, by business areas, is the following:<br />

Line <strong>of</strong> Business<br />

Thousands <strong>of</strong> euros<br />

Construction 62,857<br />

Industrial Services 91,991<br />

Environment 126,254<br />

Concessions 20,171<br />

Corporation 59,715<br />

Total 360,988<br />

During 2010, the most relevant variation took place due to the reversal <strong>of</strong> the provisions associated with tax risks,<br />

fundamentally with the deduction for exporting activities, once the judgment was given largely in favour <strong>of</strong> the <strong>ACS</strong> <strong>Group</strong><br />

at the TEAC and the audit was completed by the tax authorities in the month <strong>of</strong> July 2010. Said reversal is covered under the<br />

heading “Other pr<strong>of</strong>i t or loss” from the consolidated in income statement for the amount <strong>of</strong> EUR 39.9 million.<br />

The total amount <strong>of</strong> the payments arising from litigation made by the <strong>ACS</strong> <strong>Group</strong> during 2010 and 2009 was not signifi cant<br />

in relation to these consolidated summary fi nancial statements.<br />

The changes in current provisions during 2010 were as follows:<br />

Currents<br />

Thousands <strong>of</strong> euros<br />

122<br />

ANNUAL REPORT 2010<br />

<strong>ACS</strong> GROUP<br />

Provision for<br />

termination<br />

benefi ts<br />

Provision for<br />

completion <strong>of</strong><br />

works<br />

Provision for<br />

other traffi c<br />

operations Total<br />

Balance at 31 December 2009 13,013 112,447 142,915 268,375<br />

Additions or period charges 5,901 25,921 27,082 58,904<br />

Applications (4,313) (15,152) (46,004) (65,469)<br />

Reversals (252) (11,691) (13,901) (25,844)<br />

Exchange differences 139 (841) (1,920) (2,622)<br />

Balance at 31 December 2010 14,488 110,684 108,172 233,344