Annual Report of ACS Group - Grupo ACS

Annual Report of ACS Group - Grupo ACS

Annual Report of ACS Group - Grupo ACS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Directors’ report for the<br />

Consolidated <strong>Group</strong> for 2010<br />

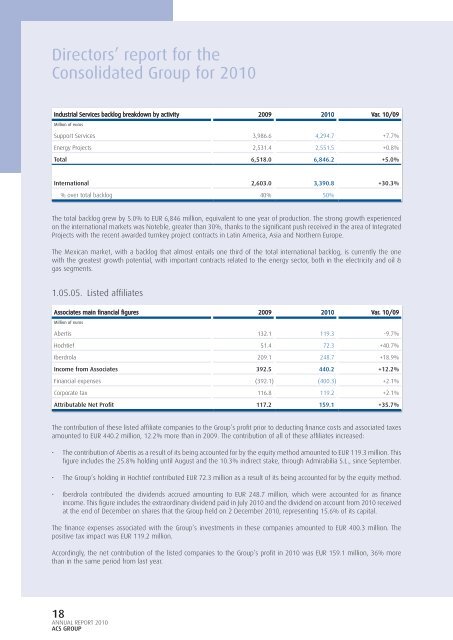

Industrial Services backlog breakdown by activity 2009 2010 Var. 10/09<br />

Million <strong>of</strong> euros<br />

Support Services 3,986.6 4,294.7 +7.7%<br />

Energy Projects 2,531.4 2,551.5 +0.8%<br />

Total 6,518.0 6,846.2 +5.0%<br />

International 2,603.0 3,390.8 +30.3%<br />

% over total backlog 40% 50%<br />

The total backlog grew by 5.0% to EUR 6,846 million, equivalent to one year <strong>of</strong> production. The strong growth experienced<br />

on the international markets was Noteble, greater than 30%, thanks to the signifi cant push received in the area <strong>of</strong> Integrated<br />

Projects with the recent awarded turnkey project contracts in Latin America, Asia and Northern Europe.<br />

The Mexican market, with a backlog that almost entails one third <strong>of</strong> the total international backlog, is currently the one<br />

with the greatest growth potential, with important contracts related to the energy sector, both in the electricity and oil &<br />

gas segments.<br />

1.05.05. Listed affi liates<br />

Associates main fi nancial fi gures 2009 2010 Var. 10/09<br />

Million <strong>of</strong> euros<br />

Abertis 132.1 119.3 -9.7%<br />

Hochtief 51.4 72.3 +40.7%<br />

Iberdrola 209.1 248.7 +18.9%<br />

Income from Associates 392.5 440.2 +12.2%<br />

Financial expenses (392.1) (400.3) +2.1%<br />

Corporate tax 116.8 119.2 +2.1%<br />

Attributable Net Pr<strong>of</strong>i t 117.2 159.1 +35.7%<br />

The contribution <strong>of</strong> these listed affi liate companies to the <strong>Group</strong>’s pr<strong>of</strong>i t prior to deducting fi nance costs and associated taxes<br />

amounted to EUR 440.2 million, 12.2% more than in 2009. The contribution <strong>of</strong> all <strong>of</strong> these affi liates increased:<br />

• The contribution <strong>of</strong> Abertis as a result <strong>of</strong> its being accounted for by the equity method amounted to EUR 119.3 million. This<br />

fi gure includes the 25.8% holding until August and the 10.3% indirect stake, through Admirabilia S.L., since September.<br />

• The <strong>Group</strong>’s holding in Hochtief contributed EUR 72.3 million as a result <strong>of</strong> its being accounted for by the equity method.<br />

• Iberdrola contributed the dividends accrued amounting to EUR 248.7 million, which were accounted for as fi nance<br />

income. This fi gure includes the extraordinary dividend paid in July 2010 and the dividend on account from 2010 received<br />

at the end <strong>of</strong> December on shares that the <strong>Group</strong> held on 2 December 2010, representing 15.6% <strong>of</strong> its capital.<br />

The fi nance expenses associated with the <strong>Group</strong>’s investments in these companies amounted to EUR 400.3 million. The<br />

positive tax impact was EUR 119.2 million.<br />

Accordingly, the net contribution <strong>of</strong> the listed companies to the <strong>Group</strong>’s pr<strong>of</strong>i t in 2010 was EUR 159.1 million, 36% more<br />

than in the same period from last year.<br />

18<br />

ANNUAL REPORT 2010<br />

<strong>ACS</strong> GROUP