Annual Report of ACS Group - Grupo ACS

Annual Report of ACS Group - Grupo ACS

Annual Report of ACS Group - Grupo ACS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

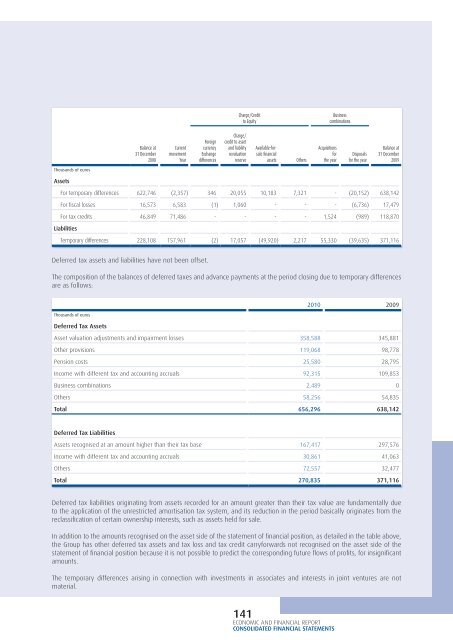

Thousands <strong>of</strong> euros<br />

Assets<br />

Balance at<br />

31 December<br />

2008<br />

Current<br />

movement<br />

Year<br />

Foreign<br />

currency<br />

Exchange<br />

differences<br />

Deferred tax assets and liabilities have not been <strong>of</strong>fset.<br />

Charge/<br />

credit to asset<br />

and liability<br />

revaluation<br />

reserve<br />

Charge/Credit<br />

to Equity<br />

Available-forsale<br />

fi nancial<br />

assets Others<br />

The composition <strong>of</strong> the balances <strong>of</strong> deferred taxes and advance payments at the period closing due to temporary differences<br />

are as follows:<br />

Deferred tax liabilities originating from assets recorded for an amount greater than their tax value are fundamentally due<br />

to the application <strong>of</strong> the unrestricted amortisation tax system, and its reduction in the period basically originates from the<br />

reclassifi cation <strong>of</strong> certain ownership interests, such as assets held for sale.<br />

In addition to the amounts recognised on the asset side <strong>of</strong> the statement <strong>of</strong> fi nancial position, as detailed in the table above,<br />

the <strong>Group</strong> has other deferred tax assets and tax loss and tax credit carryforwards not recognised on the asset side <strong>of</strong> the<br />

statement <strong>of</strong> fi nancial position because it is not possible to predict the corresponding future fl ows <strong>of</strong> pr<strong>of</strong>i ts, for insignifi cant<br />

amounts.<br />

The temporary differences arising in connection with investments in associates and interests in joint ventures are not<br />

material.<br />

141<br />

ECONOMIC AND FINANCIAL REPORT<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

Business<br />

combinations<br />

Acquisitions<br />

for<br />

the year<br />

Disposals<br />

for the year<br />

Balance at<br />

31 December<br />

2009<br />

For temporary differences 622,746 (2,357) 346 20,055 10,183 7,321 - (20,152) 638,142<br />

For fi scal losses 16,573 6,583 (1) 1,060 - - - (6,736) 17,479<br />

For tax credits 46,849 71,486 - - - - 1,524 (989) 118,870<br />

Liabilities<br />

Temporary differences 228,108 157,961 (2) 17,057 (49,920) 2,217 55,330 (39,635) 371,116<br />

Thousands <strong>of</strong> euros<br />

Deferred Tax Assets<br />

2010 2009<br />

Asset valuation adjustments and impairment losses 358,588 345,881<br />

Other provisions 119,068 98,778<br />

Pension costs 25,580 28,795<br />

Income with different tax and accounting accruals 92,315 109,853<br />

Business combinations 2,489 0<br />

Others 58,256 54,835<br />

Total 656,296 638,142<br />

Deferred Tax Liabilities<br />

Assets recognised at an amount higher than their tax base 167,417 297,576<br />

Income with different tax and accounting accruals 30,861 41,063<br />

Others 72,557 32,477<br />

Total 270,835 371,116