Biotech financing

25WmEet

25WmEet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Biotech</strong> <strong>financing</strong>: US and Europe<br />

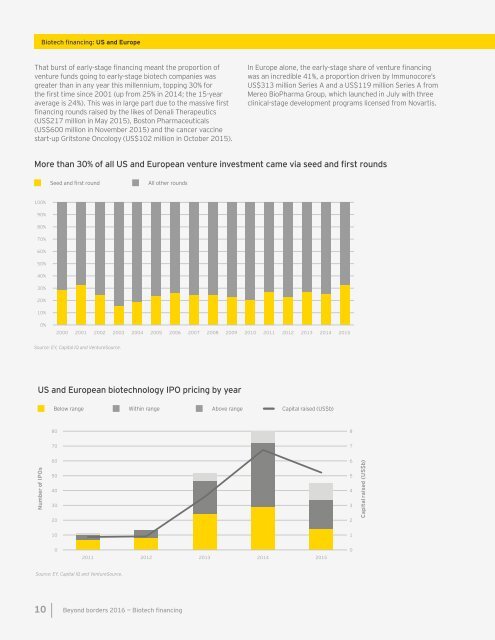

That burst of early-stage <strong>financing</strong> meant the proportion of<br />

venture funds going to early-stage biotech companies was<br />

greater than in any year this millennium, topping 30% for<br />

the first time since 2001 (up from 25% in 2014; the 15-year<br />

average is 24%). This was in large part due to the massive first<br />

<strong>financing</strong> rounds raised by the likes of Denali Therapeutics<br />

(US$217 million in May 2015), Boston Pharmaceuticals<br />

(US$600 million in November 2015) and the cancer vaccine<br />

start-up Gritstone Oncology (US$102 million in October 2015).<br />

In Europe alone, the early-stage share of venture <strong>financing</strong><br />

was an incredible 41%, a proportion driven by Immunocore’s<br />

US$313 million Series A and a US$119 million Series A from<br />

Mereo BioPharma Group, which launched in July with three<br />

clinical-stage development programs licensed from Novartis.<br />

More than 30% of all US and European venture investment came via seed and first rounds<br />

Seed and first round<br />

All other rounds<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015<br />

Source: EY, Capital IQ and VentureSource.<br />

US and European biotechnology IPO pricing by year<br />

Below range<br />

Within range<br />

Above range<br />

Capital raised (US$b)<br />

80<br />

8<br />

70<br />

7<br />

Number of IPOs<br />

60<br />

50<br />

40<br />

30<br />

20<br />

6<br />

5<br />

4<br />

3<br />

2<br />

Capital raised (US$b)<br />

10<br />

1<br />

0<br />

2011 2012 2013 2014 2015<br />

0<br />

Source: EY, Capital IQ and VentureSource.<br />

10 Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong>