Biotech financing

25WmEet

25WmEet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Biotech</strong>s in the US and Europe raised an impressive US$3.5 billion<br />

in 235 seed and Series A <strong>financing</strong>s, setting records for both<br />

dollars raised and deal volume. Boston Pharmaceuticals<br />

raised the largest-ever biotech seed investment, pulling in<br />

US$600 million in November 2015 from Gurnet Point Capital,<br />

a US$2 billion life sciences and health care investment firm<br />

founded by Serono billionaire Ernesto Bertarelli and helmed by<br />

former Sanofi CEO Chris Viehbacher.<br />

Gurnet is not an ordinary VC, and Boston Pharma isn’t an<br />

ordinary biotech. The company is pursuing an alternative searchand-develop<br />

model more typical of specialty pharma to bring<br />

in early-stage clinical assets and shepherd them through to<br />

Phase III.<br />

In Europe, the immuno-oncology start-up Immunocore raised a<br />

US$313 million Series A and earned a valuation of US$1 billion<br />

in Europe’s largest-ever venture round.<br />

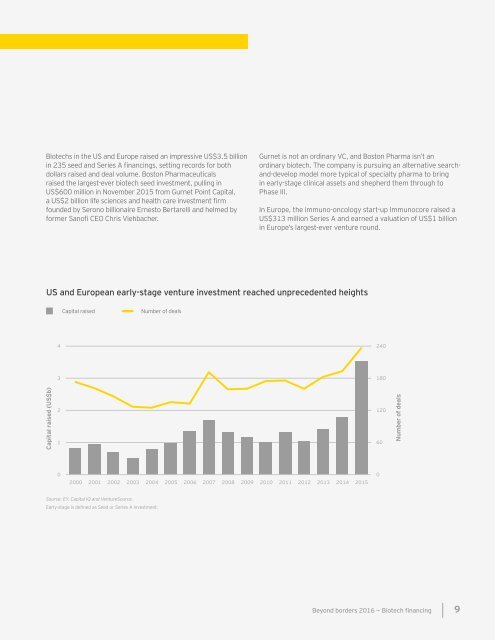

US and European early-stage venture investment reached unprecedented heights<br />

Capital raised<br />

Number of deals<br />

4<br />

240<br />

3<br />

180<br />

2<br />

120<br />

1<br />

60<br />

0<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015<br />

0<br />

Source: EY, Capital IQ and VentureSource.<br />

Early-stage is defined as Seed or Series A investment.<br />

Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong><br />

9