Biotech financing

25WmEet

25WmEet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

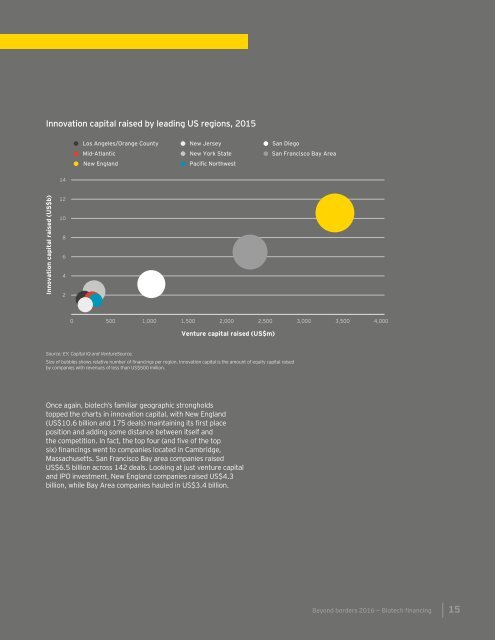

Innovation capital raised by leading US regions, 2015<br />

Los Angeles/Orange County<br />

Mid-Atlantic<br />

New England<br />

New Jersey<br />

New York State<br />

San Diego<br />

San Francisco Bay Area<br />

14<br />

Innovation capital raised (US$b)<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

Venture capital raised (US$m)<br />

Source: EY, Capital IQ and VentureSource.<br />

Size of bubbles shows relative number of <strong>financing</strong>s per region. Innovation capital is the amount of equity capital raised<br />

by companies with revenues of less than US$500 million.<br />

Once again, biotech’s familiar geographic strongholds<br />

topped the charts in innovation capital, with New England<br />

(US$10.6 billion and 175 deals) maintaining its first place<br />

position and adding some distance between itself and<br />

the competition. In fact, the top four (and five of the top<br />

six) <strong>financing</strong>s went to companies located in Cambridge,<br />

Massachusetts. San Francisco Bay area companies raised<br />

US$6.5 billion across 142 deals. Looking at just venture capital<br />

and IPO investment, New England companies raised US$4.3<br />

billion, while Bay Area companies hauled in US$3.4 billion.<br />

Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong><br />

15