Biotech financing

25WmEet

25WmEet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

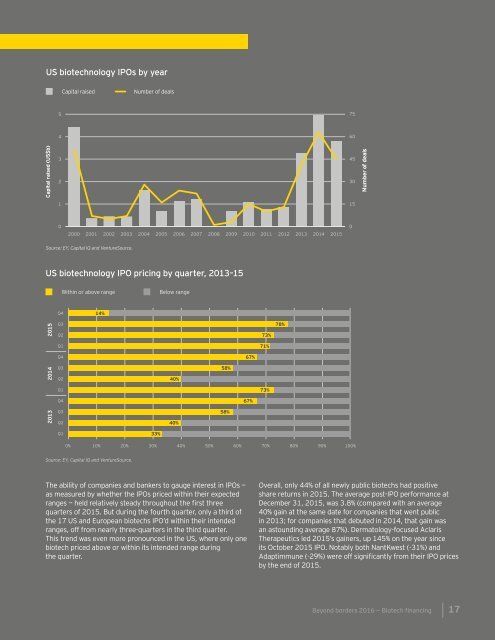

US biotechnology IPOs by year<br />

Capital raised<br />

Number of deals<br />

5<br />

75<br />

4<br />

60<br />

3<br />

2<br />

45<br />

30<br />

Number of deals<br />

1<br />

15<br />

0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

0<br />

Source: EY, Capital IQ and VentureSource.<br />

US biotechnology IPO pricing by quarter, 2013–15<br />

Within or above range<br />

Below range<br />

Q4<br />

14%<br />

2013 2014 2015<br />

Q3<br />

Q2<br />

Q1<br />

Q4<br />

Q3<br />

Q2<br />

Q1<br />

Q4<br />

Q3<br />

Q2<br />

40%<br />

40%<br />

58%<br />

58%<br />

67%<br />

67%<br />

73%<br />

71%<br />

73%<br />

78%<br />

Q1<br />

33%<br />

Source: EY, Capital IQ and VentureSource.<br />

The ability of companies and bankers to gauge interest in IPOs —<br />

as measured by whether the IPOs priced within their expected<br />

ranges — held relatively steady throughout the first three<br />

quarters of 2015. But during the fourth quarter, only a third of<br />

the 17 US and European biotechs IPO’d within their intended<br />

ranges, off from nearly three-quarters in the third quarter.<br />

This trend was even more pronounced in the US, where only one<br />

biotech priced above or within its intended range during<br />

the quarter.<br />

Overall, only 44% of all newly public biotechs had positive<br />

share returns in 2015. The average post-IPO performance at<br />

December 31, 2015, was 3.8% (compared with an average<br />

40% gain at the same date for companies that went public<br />

in 2013; for companies that debuted in 2014, that gain was<br />

an astounding average 87%). Dermatology-focused Aclaris<br />

Therapeutics led 2015’s gainers, up 145% on the year since<br />

its October 2015 IPO. Notably both NantKwest (-31%) and<br />

Adaptimmune (-29%) were off significantly from their IPO prices<br />

by the end of 2015.<br />

Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong><br />

17