Biotech financing

25WmEet

25WmEet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

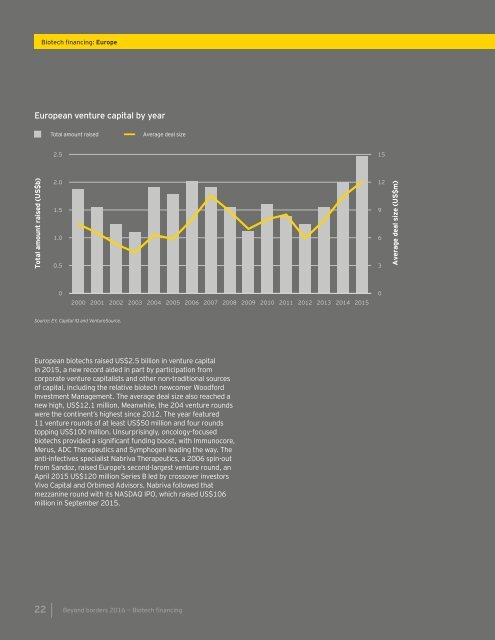

<strong>Biotech</strong> <strong>financing</strong>: Europe<br />

European venture capital by year<br />

Total amount raised<br />

Average deal size<br />

15<br />

12<br />

9<br />

6<br />

3<br />

0<br />

Source: EY, Capital IQ and VentureSource.<br />

European biotechs raised US$2.5 billion in venture capital<br />

in 2015, a new record aided in part by participation from<br />

corporate venture capitalists and other non-traditional sources<br />

of capital, including the relative biotech newcomer Woodford<br />

Investment Management. The average deal size also reached a<br />

new high, US$12.1 million. Meanwhile, the 204 venture rounds<br />

were the continent’s highest since 2012. The year featured<br />

11 venture rounds of at least US$50 million and four rounds<br />

topping US$100 million. Unsurprisingly, oncology-focused<br />

biotechs provided a significant funding boost, with Immunocore,<br />

Merus, ADC Therapeutics and Symphogen leading the way. The<br />

anti-infectives specialist Nabriva Therapeutics, a 2006 spin-out<br />

from Sandoz, raised Europe’s second-largest venture round, an<br />

April 2015 US$120 million Series B led by crossover investors<br />

Vivo Capital and Orbimed Advisors. Nabriva followed that<br />

mezzanine round with its NASDAQ IPO, which raised US$106<br />

million in September 2015.<br />

22 Beyond borders 2016 — <strong>Biotech</strong> <strong>financing</strong>