Committed to growth

EuroChem-2015-Annual-Report-v2

EuroChem-2015-Annual-Report-v2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The moni<strong>to</strong>ring and controlling of credit risk is performed by the corporate treasury function of the Group. The credit policy requires the<br />

performance of credit evaluations and ratings of cus<strong>to</strong>mers. The credit quality of each new cus<strong>to</strong>mer is analyzed before the Group provides<br />

it with the standard terms of delivery and payment. The Group gives preference <strong>to</strong> cus<strong>to</strong>mers with an independent credit rating. New<br />

cus<strong>to</strong>mers without an independent credit rating are evaluated on a sample basis by an appointed rating agency or the score and credit limits<br />

for new cus<strong>to</strong>mers are set by the appointed insurance company. The credit quality of other cus<strong>to</strong>mers is assessed taking in<strong>to</strong> account their<br />

financial position, past experience and other fac<strong>to</strong>rs.<br />

Cus<strong>to</strong>mers that do not meet the credit quality requirements are supplied on a prepayment basis only.<br />

Although the collection of receivables could be influenced by economic fac<strong>to</strong>rs, management believes that there is no significant risk of loss<br />

<strong>to</strong> the Group beyond the provision already recorded (Note 14).<br />

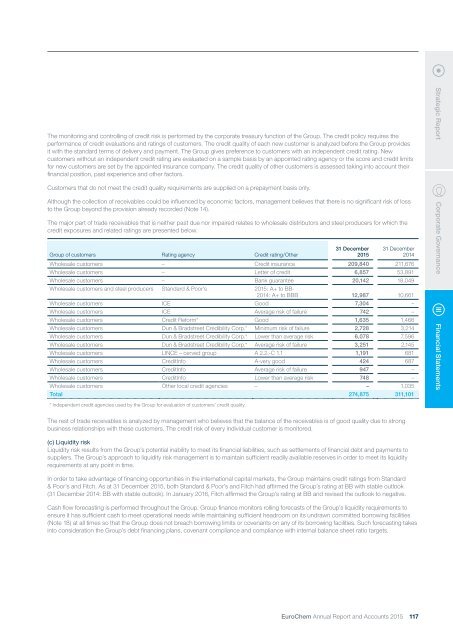

The major part of trade receivables that is neither past due nor impaired relates <strong>to</strong> wholesale distribu<strong>to</strong>rs and steel producers for which the<br />

credit exposures and related ratings are presented below.<br />

Group of cus<strong>to</strong>mers Rating agency Credit rating/Other<br />

31 December<br />

2015<br />

31 December<br />

2014<br />

Wholesale cus<strong>to</strong>mers – Credit insurance 209,840 211,676<br />

Wholesale cus<strong>to</strong>mers – Letter of credit 6,857 53,891<br />

Wholesale cus<strong>to</strong>mers – Bank guarantee 20,142 18,049<br />

Wholesale cus<strong>to</strong>mers and steel producers Standard & Poor’s 2015: A+ <strong>to</strong> BB-<br />

2014: A+ <strong>to</strong> BBB 12,987 10,661<br />

Wholesale cus<strong>to</strong>mers ICE Good 7,304 –<br />

Wholesale cus<strong>to</strong>mers ICE Average risk of failure 742 –<br />

Wholesale cus<strong>to</strong>mers Credit Reform* Good 1,635 1,466<br />

Wholesale cus<strong>to</strong>mers Dun & Bradstreet Credibility Corp.* Minimum risk of failure 2,728 3,214<br />

Wholesale cus<strong>to</strong>mers Dun & Bradstreet Credibility Corp.* Lower than average risk 6,078 7,596<br />

Wholesale cus<strong>to</strong>mers Dun & Bradstreet Credibility Corp.* Average risk of failure 3,251 2,145<br />

Wholesale cus<strong>to</strong>mers LINCE – cerved group A 2.2.-C 1.1 1,191 681<br />

Wholesale cus<strong>to</strong>mers CreditInfo A-very good 424 687<br />

Wholesale cus<strong>to</strong>mers CreditInfo Average risk of failure 947 –<br />

Wholesale cus<strong>to</strong>mers CreditInfo Lower than average risk 748 –<br />

Wholesale cus<strong>to</strong>mers Other local credit agencies – – 1,035<br />

Total 274,875 311,101<br />

Strategic Report Corporate Governance Financial Statements<br />

* Independent credit agencies used by the Group for evaluation of cus<strong>to</strong>mers’ credit quality.<br />

The rest of trade receivables is analyzed by management who believes that the balance of the receivables is of good quality due <strong>to</strong> strong<br />

business relationships with these cus<strong>to</strong>mers. The credit risk of every individual cus<strong>to</strong>mer is moni<strong>to</strong>red.<br />

(c) Liquidity risk<br />

Liquidity risk results from the Group’s potential inability <strong>to</strong> meet its financial liabilities, such as settlements of financial debt and payments <strong>to</strong><br />

suppliers. The Group’s approach <strong>to</strong> liquidity risk management is <strong>to</strong> maintain sufficient readily available reserves in order <strong>to</strong> meet its liquidity<br />

requirements at any point in time.<br />

In order <strong>to</strong> take advantage of financing opportunities in the international capital markets, the Group maintains credit ratings from Standard<br />

& Poor’s and Fitch. As at 31 December 2015, both Standard & Poor’s and Fitch had affirmed the Group’s rating at BB with stable outlook<br />

(31 December 2014: BB with stable outlook). In January 2016, Fitch affirmed the Group’s rating at BB and revised the outlook <strong>to</strong> negative.<br />

Cash flow forecasting is performed throughout the Group. Group finance moni<strong>to</strong>rs rolling forecasts of the Group’s liquidity requirements <strong>to</strong><br />

ensure it has sufficient cash <strong>to</strong> meet operational needs while maintaining sufficient headroom on its undrawn committed borrowing facilities<br />

(Note 18) at all times so that the Group does not breach borrowing limits or covenants on any of its borrowing facilities. Such forecasting takes<br />

in<strong>to</strong> consideration the Group’s debt financing plans, covenant compliance and compliance with internal balance sheet ratio targets.<br />

EuroChem Annual Report and Accounts 2015 117