Committed to growth

EuroChem-2015-Annual-Report-v2

EuroChem-2015-Annual-Report-v2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Strategy<br />

Maintaining strategic<br />

discipline<br />

01<br />

Cost leadership through<br />

vertical integration<br />

Strategic priorities<br />

• Target self-sufficiency (ammonia, phosphate<br />

rock, potash)<br />

• Enhance cash cost position and reduce risk/<br />

volatility of earnings<br />

Associated risks<br />

• Shrinking natural gas cost differential between<br />

Russia and Europe/US<br />

• Vertical integration results in higher operating<br />

leverage which may be detrimental <strong>to</strong> cost position<br />

in a period of prolonged market deterioration<br />

• New capacity, especially ammonia, in other<br />

low-cost regions<br />

Performance/KPIs<br />

Our competitiveness depends on the cost of<br />

delivering products <strong>to</strong> key markets and their<br />

quality. Our cost and quality advantages are driven<br />

by the ownership and control we have over the<br />

manufacturing and distributing of our products –<br />

the very essence of our vertically integrated business<br />

model. (See charts below and pages 24, 28).<br />

02<br />

Growth through potash<br />

Strategic priorities<br />

• Build leading low-cost potash production<br />

by the end of 2017<br />

• Maximize internal processing of potash<br />

for NPK, NK, SOP production<br />

Associated risks<br />

• Technical risks relating <strong>to</strong> the construction<br />

of potash mines<br />

• Commercial risks<br />

Performance/KPIs<br />

We have secured access <strong>to</strong> over ten billion <strong>to</strong>nnes<br />

of proven and probable potash reserves. With<br />

initial production set <strong>to</strong> commence from late 2017,<br />

our two key sites will have over 8.3 MMT KCI<br />

(5.0 MMT K 2 O) of capacity once fully ramped up,<br />

which is equivalent <strong>to</strong> approximately 10% of current<br />

global supply. We derive our completion rate from<br />

capital expenditures incurred at each project.<br />

The completion rates provided below represent<br />

the percentage of planned first phase <strong>to</strong>tal<br />

capital expenditure.<br />

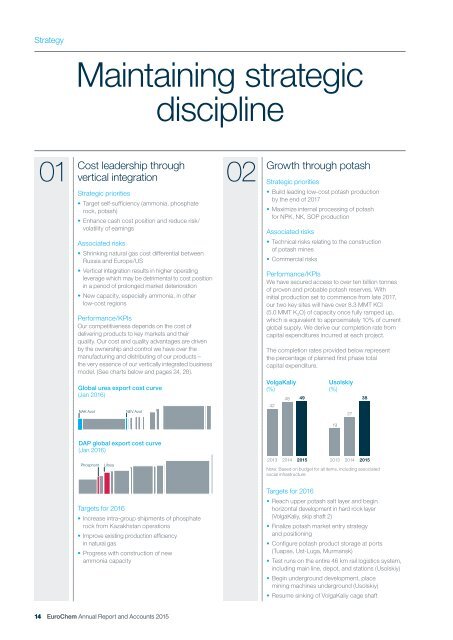

Global urea export cost curve<br />

(Jan 2016)<br />

NAK Azot<br />

NEV Azot<br />

VolgaKaliy<br />

(%)<br />

42<br />

48<br />

49<br />

Usolskiy<br />

(%)<br />

27<br />

38<br />

19<br />

DAP global export cost curve<br />

(Jan 2016)<br />

Phosphorit<br />

Lifosa<br />

2013<br />

2014<br />

2015<br />

2013<br />

2014<br />

2015<br />

Note: Based on budget for all items, including associated<br />

social infrastructure<br />

Targets for 2016<br />

• Increase intra-group shipments of phosphate<br />

rock from Kazakhstan operations<br />

• Improve existing production efficiency<br />

in natural gas<br />

• Progress with construction of new<br />

ammonia capacity<br />

Targets for 2016<br />

• Reach upper potash salt layer and begin<br />

horizontal development in hard rock layer<br />

(VolgaKaliy, skip shaft 2)<br />

• Finalize potash market entry strategy<br />

and positioning<br />

• Configure potash product s<strong>to</strong>rage at ports<br />

(Tuapse, Ust-Luga, Murmansk)<br />

• Test runs on the entire 46 km rail logistics system,<br />

including main line, depot, and stations (Usolskiy)<br />

• Begin underground development, place<br />

mining machines underground (Usolskiy)<br />

• Resume sinking of VolgaKaliy cage shaft<br />

14 EuroChem Annual Report and Accounts 2015