Committed to growth

EuroChem-2015-Annual-Report-v2

EuroChem-2015-Annual-Report-v2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

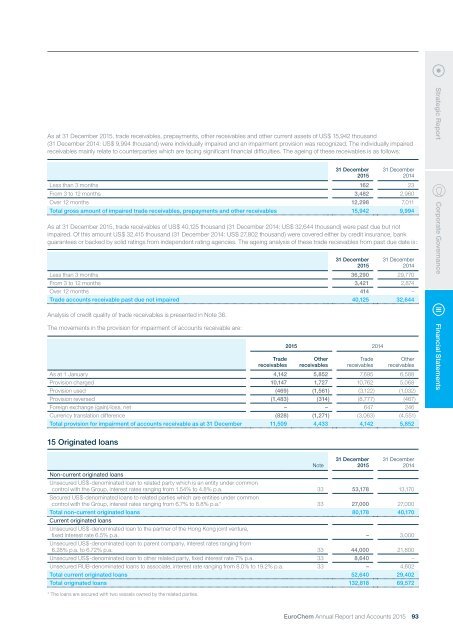

As at 31 December 2015, trade receivables, prepayments, other receivables and other current assets of US$ 15,942 thousand<br />

(31 December 2014: US$ 9,994 thousand) were individually impaired and an impairment provision was recognized. The individually impaired<br />

receivables mainly relate <strong>to</strong> counterparties which are facing significant financial difficulties. The ageing of these receivables is as follows:<br />

31 December<br />

2015<br />

31 December<br />

2014<br />

Less than 3 months 162 23<br />

From 3 <strong>to</strong> 12 months 3,482 2,960<br />

Over 12 months 12,298 7,011<br />

Total gross amount of impaired trade receivables, prepayments and other receivables 15,942 9,994<br />

As at 31 December 2015, trade receivables of US$ 40,125 thousand (31 December 2014: US$ 32,644 thousand) were past due but not<br />

impaired. Of this amount US$ 32,415 thousand (31 December 2014: US$ 27,802 thousand) were covered either by credit insurance, bank<br />

guarantees or backed by solid ratings from independent rating agencies. The ageing analysis of these trade receivables from past due date is:<br />

31 December<br />

2015<br />

31 December<br />

2014<br />

Less than 3 months 36,290 29,770<br />

From 3 <strong>to</strong> 12 months 3,421 2,874<br />

Over 12 months 414 –<br />

Trade accounts receivable past due not impaired 40,125 32,644<br />

Analysis of credit quality of trade receivables is presented in Note 36.<br />

The movements in the provision for impairment of accounts receivable are:<br />

Trade<br />

receivables<br />

2015 2014<br />

Other<br />

receivables<br />

Trade<br />

receivables<br />

Other<br />

receivables<br />

As at 1 January 4,142 5,852 7,695 6,588<br />

Provision charged 10,147 1,727 10,762 5,068<br />

Provision used (469) (1,561) (3,122) (1,032)<br />

Provision reversed (1,483) (314) (8,777) (467)<br />

Foreign exchange (gain)/loss, net – – 647 246<br />

Currency translation difference (828) (1,271) (3,063) (4,551)<br />

Total provision for impairment of accounts receivable as at 31 December 11,509 4,433 4,142 5,852<br />

Strategic Report Corporate Governance Financial Statements<br />

15 Originated loans<br />

Note<br />

31 December<br />

2015<br />

31 December<br />

2014<br />

Non-current originated loans<br />

Unsecured US$-denominated loan <strong>to</strong> related party which is an entity under common<br />

control with the Group, interest rates ranging from 1.54% <strong>to</strong> 4.8% p.a. 33 53,178 13,170<br />

Secured US$-denominated loans <strong>to</strong> related parties which are entities under common<br />

control with the Group, interest rates ranging from 6.7% <strong>to</strong> 8.8% p.a.* 33 27,000 27,000<br />

Total non-current originated loans 80,178 40,170<br />

Current originated loans<br />

Unsecured US$-denominated loan <strong>to</strong> the partner of the Hong Kong joint venture,<br />

fixed interest rate 6.5% p.a. – 3,000<br />

Unsecured US$-denominated loan <strong>to</strong> parent company, interest rates ranging from<br />

6.28% p.a. <strong>to</strong> 6.72% p.a. 33 44,000 21,800<br />

Unsecured US$-denominated loan <strong>to</strong> other related party, fixed interest rate 7% p.a. 33 8,640 –<br />

Unsecured RUB-denominated loans <strong>to</strong> associate, interest rate ranging from 8.0% <strong>to</strong> 19.2% p.a. 33 – 4,602<br />

Total current originated loans 52,640 29,402<br />

Total originated loans 132,818 69,572<br />

* The loans are secured with two vessels owned by the related parties.<br />

EuroChem Annual Report and Accounts 2015 93