Committed to growth

EuroChem-2015-Annual-Report-v2

EuroChem-2015-Annual-Report-v2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements<br />

Notes <strong>to</strong> the Consolidated Financial Statements<br />

for the year ended 31 December 2015 continued<br />

(all amounts are presented in thousands of US dollars, unless otherwise stated)<br />

2 Basis of preparation and significant accounting policies continued<br />

All capitalized exploration and evaluation expenditures are assessed for impairment if facts and circumstances indicate that impairment may<br />

exist. Exploration and evaluation assets are also tested for impairment once commercial reserves are found, before the assets are transferred<br />

<strong>to</strong> development properties.<br />

Operating leases<br />

Where the Group is a lessee in a lease which does not transfer substantially all the risks and rewards incidental <strong>to</strong> ownership from the lessor<br />

<strong>to</strong> the Group, the <strong>to</strong>tal lease payments are charged <strong>to</strong> profit and loss on a straight-line basis over the period of the lease. The lease term is the<br />

non-cancellable period for which the lessee has contracted <strong>to</strong> lease the asset <strong>to</strong>gether with any further terms for which the lessee has the<br />

option <strong>to</strong> continue <strong>to</strong> lease the asset, with or without further payment, when at the inception of the lease it is reasonably certain that the lessee<br />

will exercise the option.<br />

When assets are leased out under an operating lease, the lease payments receivable are recognized as rental income on a straight-line basis<br />

over the lease term.<br />

Goodwill<br />

Goodwill is carried at cost less accumulated impairment losses, if any. The Group tests goodwill for impairment at least annually and whenever<br />

there are indications that goodwill may be impaired. The carrying value of goodwill is compared <strong>to</strong> the relevant amount, which is the higher of<br />

value in use and the fair value less cost of disposal. Any impairment is recognized immediately as an expense and is not subsequently reversed.<br />

Goodwill is allocated <strong>to</strong> the cash-generating units, or groups of cash-generating units, that are expected <strong>to</strong> benefit from the synergies of the<br />

business combination. Such units or groups of units represent the lowest level at which the Group moni<strong>to</strong>rs goodwill and are not larger than<br />

an operating segment.<br />

Gains or losses on disposal of an operation within a cash generating unit <strong>to</strong> which goodwill has been allocated include the carrying amount<br />

of goodwill associated with the operation disposed of, generally measured on the basis of the relative values of the operation disposed of and<br />

the portion of the cash-generating unit which is retained.<br />

Mineral rights<br />

Mineral rights include rights for evaluation, exploration and production of mineral resources under the licenses or agreements. Such assets<br />

are carried at cost, amortization is charged on a straight line basis over the shorter of the valid period of the license or the agreement, or the<br />

expected life of mine, starting from the date when production activities commence. The costs directly attributable <strong>to</strong> acquisition of rights for<br />

evaluation, exploration and production are capitalized as a part of the mineral rights. If the reserves related <strong>to</strong> the mineral rights are not<br />

economically viable, the carrying amount of such mineral rights is written off.<br />

Mineral resources are recognized as assets when acquired as part of a business combination and then depleted using the unit-of-production<br />

method for oil and gas assets based on <strong>to</strong>tal proved mineral reserves and straight line method for other assets. Proved mineral reserves reflect<br />

the economically recoverable quantities which can be legally recovered in the future from known mineral deposits and were determined by<br />

independent professional appraisers when acquired as part of a business combination and are subject update in future periods.<br />

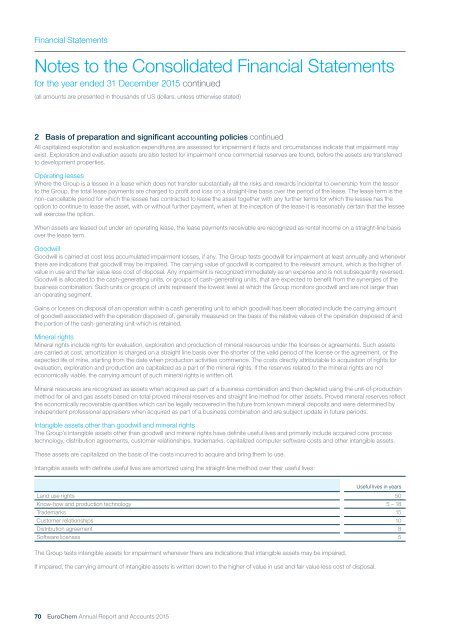

Intangible assets other than goodwill and mineral rights<br />

The Group’s intangible assets other than goodwill and mineral rights have definite useful lives and primarily include acquired core process<br />

technology, distribution agreements, cus<strong>to</strong>mer relationships, trademarks, capitalized computer software costs and other intangible assets.<br />

These assets are capitalized on the basis of the costs incurred <strong>to</strong> acquire and bring them <strong>to</strong> use.<br />

Intangible assets with definite useful lives are amortized using the straight-line method over their useful lives:<br />

Useful lives in years<br />

Land use rights 50<br />

Know-how and production technology 5 – 18<br />

Trademarks 15<br />

Cus<strong>to</strong>mer relationships 10<br />

Distribution agreement 8<br />

Software licenses 5<br />

The Group tests intangible assets for impairment whenever there are indications that intangible assets may be impaired.<br />

If impaired, the carrying amount of intangible assets is written down <strong>to</strong> the higher of value in use and fair value less cost of disposal.<br />

70 EuroChem Annual Report and Accounts 2015