GSN Digital Edition April 2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

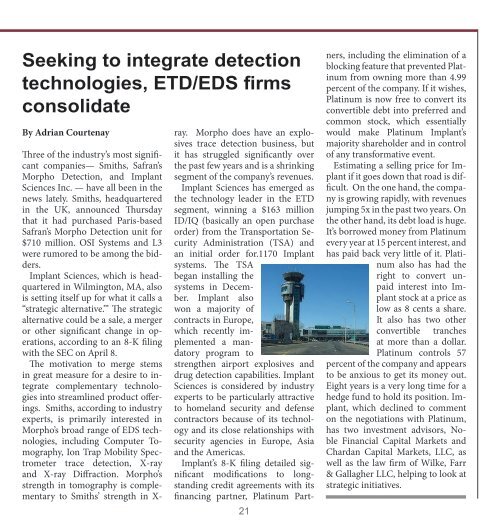

Seeking to integrate detection<br />

technologies, ETD/EDS firms<br />

consolidate<br />

By Adrian Courtenay<br />

Three of the industry’s most significant<br />

companies— Smiths, Safran’s<br />

Morpho Detection, and Implant<br />

Sciences Inc. — have all been in the<br />

news lately. Smiths, headquartered<br />

in the UK, announced Thursday<br />

that it had purchased Paris-based<br />

Safran’s Morpho Detection unit for<br />

$710 million. OSI Systems and L3<br />

were rumored to be among the bidders.<br />

Implant Sciences, which is headquartered<br />

in Wilmington, MA, also<br />

is setting itself up for what it calls a<br />

“strategic alternative.’” The strategic<br />

alternative could be a sale, a merger<br />

or other significant change in operations,<br />

according to an 8-K filing<br />

with the SEC on <strong>April</strong> 8.<br />

The motivation to merge stems<br />

in great measure for a desire to integrate<br />

complementary technologies<br />

into streamlined product offerings.<br />

Smiths, according to industry<br />

experts, is primarily interested in<br />

Morpho’s broad range of EDS technologies,<br />

including Computer Tomography,<br />

Ion Trap Mobility Spectrometer<br />

trace detection, X-ray<br />

and X-ray Diffraction. Morpho’s<br />

strength in tomography is complementary<br />

to Smiths’ strength in X-<br />

21<br />

ray. Morpho does have an explosives<br />

trace detection business, but<br />

it has struggled significantly over<br />

the past few years and is a shrinking<br />

segment of the company’s revenues.<br />

Implant Sciences has emerged as<br />

the technology leader in the ETD<br />

segment, winning a $163 million<br />

ID/IQ (basically an open purchase<br />

order) from the Transportation Security<br />

Administration (TSA) and<br />

an initial order for.1170 Implant<br />

systems. The TSA<br />

began installing the<br />

systems in December.<br />

Implant also<br />

won a majority of<br />

contracts in Europe,<br />

which recently implemented<br />

a mandatory<br />

program to<br />

strengthen airport explosives and<br />

drug detection capabilities. Implant<br />

Sciences is considered by industry<br />

experts to be particularly attractive<br />

to homeland security and defense<br />

contractors because of its technology<br />

and its close relationships with<br />

security agencies in Europe, Asia<br />

and the Americas.<br />

Implant’s 8-K filing detailed significant<br />

modifications to longstanding<br />

credit agreements with its<br />

financing partner, Platinum Partners,<br />

including the elimination of a<br />

blocking feature that prevented Platinum<br />

from owning more than 4.99<br />

percent of the company. If it wishes,<br />

Platinum is now free to convert its<br />

convertible debt into preferred and<br />

common stock, which essentially<br />

would make Platinum Implant’s<br />

majority shareholder and in control<br />

of any transformative event.<br />

Estimating a selling price for Implant<br />

if it goes down that road is difficult.<br />

On the one hand, the company<br />

is growing rapidly, with revenues<br />

jumping 5x in the past two years. On<br />

the other hand, its debt load is huge.<br />

It’s borrowed money from Platinum<br />

every year at 15 percent interest, and<br />

has paid back very little of it. Platinum<br />

also has had the<br />

right to convert unpaid<br />

interest into Implant<br />

stock at a price as<br />

low as 8 cents a share.<br />

It also has two other<br />

convertible tranches<br />

at more than a dollar.<br />

Platinum controls 57<br />

percent of the company and appears<br />

to be anxious to get its money out.<br />

Eight years is a very long time for a<br />

hedge fund to hold its position. Implant,<br />

which declined to comment<br />

on the negotiations with Platinum,<br />

has two investment advisors, Noble<br />

Financial Capital Markets and<br />

Chardan Capital Markets, LLC, as<br />

well as the law firm of Wilke, Farr<br />

& Gallagher LLC, helping to look at<br />

strategic initiatives.