You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

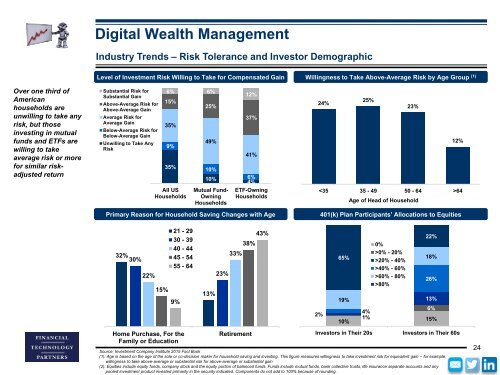

Digital Wealth Management<br />

Industry Trends – Risk Tolerance and Investor Demographic<br />

Over one third of<br />

American<br />

households are<br />

unwilling to take any<br />

risk, but those<br />

investing in mutual<br />

funds and ETFs are<br />

willing to take<br />

average risk or more<br />

for similar riskadjusted<br />

return<br />

Level of Investment Risk Willing to Take for Compensated Gain<br />

Substantial Risk for<br />

Substantial Gain<br />

Above-Average Risk for<br />

Above-Average Gain<br />

Average Risk for<br />

Average Gain<br />

Below-Average Risk for<br />

Below-Average Gain<br />

Unwilling to Take Any<br />

Risk<br />

6% 6%<br />

15%<br />

35%<br />

9%<br />

35%<br />

All US<br />

Households<br />

25%<br />

49%<br />

10%<br />

10%<br />

Mutual Fund-<br />

Owning<br />

Households<br />

12%<br />

37%<br />

41%<br />

6%<br />

4%<br />

ETF-Owning<br />

Households<br />

Primary Reason for Household Saving Changes with Age<br />

Willingness to Take Above-Average Risk by Age Group (1)<br />

24%<br />

25%<br />

23%<br />

12%<br />

64<br />

Age of Head of Household<br />

401(k) Plan Participants’ Allocations to Equities<br />

32%<br />

30%<br />

22%<br />

15%<br />

21 - 29<br />

30 - 39<br />

40 - 44<br />

45 - 54<br />

55 - 64<br />

9%<br />

43%<br />

38%<br />

33%<br />

23%<br />

13%<br />

2%<br />

65%<br />

19%<br />

10%<br />

4%<br />

1%<br />

0%<br />

>0% - 20%<br />

>20% - 40%<br />

>40% - 60%<br />

>60% - 80%<br />

>80%<br />

22%<br />

18%<br />

26%<br />

13%<br />

6%<br />

15%<br />

Home Purchase, For the<br />

Family or Education<br />

Retirement<br />

Investors in Their 20s<br />

Investors in Their 60s<br />

Source: Investment Company Institute 2015 Fact Book<br />

(1): Age is based on the age of the sole or co-decision maker for household saving and investing. This figure measures willingness to take investment risk for equivalent gain – for example,<br />

willingness to take above-average or substantial risk for above-average or substantial gain<br />

(2): Equities include equity funds, company stock and the equity portion of balanced funds. Funds include mutual funds, bank collective trusts, life insurance separate accounts and any<br />

pooled investment product invested primarily in the security indicated. Components do not add to 100% because of rounding.<br />

24