You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Retirement Account<br />

Education Account<br />

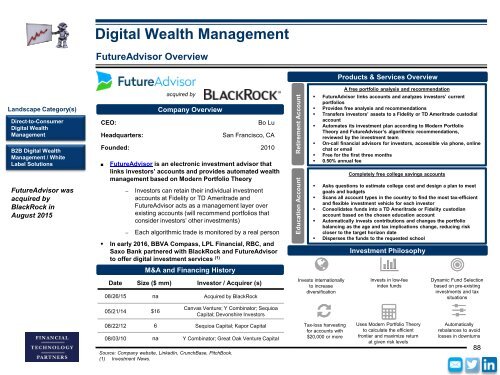

Digital Wealth Management<br />

FutureAdvisor Overview<br />

Landscape Category(s)<br />

Direct-to-Consumer<br />

Digital Wealth<br />

Management<br />

B2B Digital Wealth<br />

Management / White<br />

Label Solutions<br />

FutureAdvisor was<br />

acquired by<br />

BlackRock in<br />

August 2015<br />

CEO:<br />

Headquarters:<br />

Company Overview<br />

M&A and Financing History<br />

Date Size ($ mm) Investor / Acquirer (s)<br />

08/26/15 na Acquired by BlackRock<br />

Bo Lu<br />

San Francisco, CA<br />

Founded: 2010<br />

■<br />

acquired by<br />

FutureAdvisor is an electronic investment advisor that<br />

links investors’ accounts and provides automated wealth<br />

management based on Modern Portfolio Theory<br />

– Investors can retain their individual investment<br />

accounts at Fidelity or TD Ameritrade and<br />

FutureAdvisor acts as a management layer over<br />

existing accounts (will recommend portfolios that<br />

consider investors’ other investments)<br />

– Each algorithmic trade is monitored by a real person<br />

• In early 2016, BBVA Compass, LPL Financial, RBC, and<br />

Saxo Bank partnered with BlackRock and FutureAdvisor<br />

to offer digital investment services (1)<br />

Invests internationally<br />

to increase<br />

diversification<br />

Products & Services Overview<br />

A free portfolio analysis and recommendation<br />

• FutureAdvisor links accounts and analyzes investors’ current<br />

portfolios<br />

• Provides free analysis and recommendations<br />

• Transfers investors’ assets to a Fidelity or TD Ameritrade custodial<br />

account<br />

• Automates its investment plan according to Modern Portfolio<br />

Theory and FutureAdvisor’s algorithmic recommendations,<br />

reviewed by the investment team<br />

• On-call financial advisors for investors, accessible via phone, online<br />

chat or email<br />

• Free for the first three months<br />

• 0.50% annual fee<br />

Completely free college savings accounts<br />

• Asks questions to estimate college cost and design a plan to meet<br />

goals and budgets<br />

• Scans all account types in the country to find the most tax-efficient<br />

and flexible investment vehicle for each investor<br />

• Consolidates funds into a TD Ameritrade or Fidelity custodian<br />

account based on the chosen education account<br />

• Automatically invests contributions and changes the portfolio<br />

balancing as the age and tax implications change, reducing risk<br />

closer to the target horizon date<br />

• Disperses the funds to the requested school<br />

Investment Philosophy<br />

Invests in low-fee<br />

index funds<br />

Dynamic Fund Selection<br />

based on pre-existing<br />

investments and tax<br />

situations<br />

05/21/14 $16<br />

Canvas Venture; Y Combinator; Sequioa<br />

Capital; Devonshire Investors<br />

08/22/12 6 Sequioa Capital; Kapor Capital<br />

08/03/10 na Y Combinator; Great Oak Venture Capital<br />

Source: Company website, LinkedIn, CrunchBase, PitchBook.<br />

(1) Investment News.<br />

Tax-loss harvesting<br />

for accounts with<br />

$20,000 or more<br />

Uses Modern Portfolio Theory<br />

to calculate the efficient<br />

frontier and maximize return<br />

at given risk levels<br />

Automatically<br />

rebalances to avoid<br />

losses in downturns<br />

88