You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

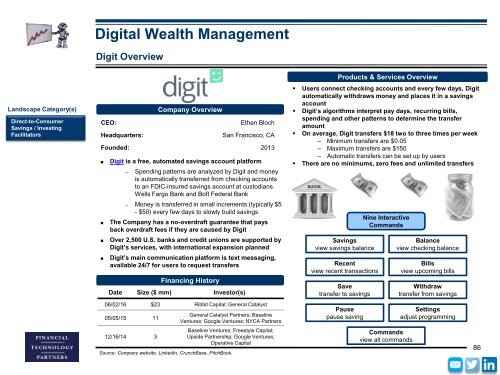

Digital Wealth Management<br />

Digit Overview<br />

Landscape Category(s)<br />

Direct-to-Consumer<br />

Savings / Investing<br />

Facilitators<br />

CEO:<br />

Headquarters:<br />

Date Size ($ mm) Investor(s)<br />

06/02/16 $23 Ribbit Capital; General Catalyst<br />

05/05/15 11<br />

12/16/14 3<br />

Company Overview<br />

Financing History<br />

Ethan Bloch<br />

San Francisco, CA<br />

Founded: 2013<br />

■<br />

■<br />

■<br />

■<br />

Digit is a free, automated savings account platform<br />

– Spending patterns are analyzed by Digit and money<br />

is automatically transferred from checking accounts<br />

to an FDIC-insured savings account at custodians<br />

Wells Fargo Bank and BofI Federal Bank<br />

– Money is transferred in small increments (typically $5<br />

- $50) every few days to slowly build savings<br />

The Company has a no-overdraft guarantee that pays<br />

back overdraft fees if they are caused by Digit<br />

Over 2,500 U.S. banks and credit unions are supported by<br />

Digit’s services, with international expansion planned<br />

Digit’s main communication platform is text messaging,<br />

available 24/7 for users to request transfers<br />

General Catalyst Partners; Baseline<br />

Ventures; Google Ventures; NYCA Partners<br />

Baseline Ventures; Freestyle Capital;<br />

Upside Partnership; Google Ventures;<br />

Operative Capital<br />

Source: Company website, LinkedIn, CrunchBase, PitchBook.<br />

Products & Services Overview<br />

• Users connect checking accounts and every few days, Digit<br />

automatically withdraws money and places it in a savings<br />

account<br />

• Digit’s algorithms interpret pay days, recurring bills,<br />

spending and other patterns to determine the transfer<br />

amount<br />

• On average, Digit transfers $18 two to three times per week<br />

‒ Minimum transfers are $0.05<br />

‒ Maximum transfers are $150<br />

‒ Automatic transfers can be set up by users<br />

• There are no minimums, zero fees and unlimited transfers<br />

Savings<br />

view savings balance<br />

Recent<br />

view recent transactions<br />

Save<br />

transfer to savings<br />

Pause<br />

pause saving<br />

Nine Interactive<br />

Commands<br />

Commands<br />

view all commands<br />

Balance<br />

view checking balance<br />

Bills<br />

view upcoming bills<br />

Withdraw<br />

transfer from savings<br />

Settings<br />

adjust programming<br />

86