Electricity & Gas Prices in Ireland

8fCy301FqPp

8fCy301FqPp

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

14 ENERGY POLICY STATISTICAL SUPPORT UNIT<br />

network length at the end of 2013 was 2,467 km while that of the distribution networks was 11,218 km 13 . The Irish<br />

system has three compressor stations, Beattock and Brighouse Bay <strong>in</strong> southwest Scotland, and Midleton near<br />

Cork. The high pressure transmission network conveys gas from two entry po<strong>in</strong>ts (at Inch and Moffat) to directly<br />

connected customers and distribution networks throughout <strong>Ireland</strong>, as well as to connected systems at exit po<strong>in</strong>ts<br />

<strong>in</strong> Scotland (the Scotland–Northern <strong>Ireland</strong> Pipel<strong>in</strong>e) and the Isle of Man.<br />

The maximum import capacity for the <strong>in</strong>terconnectors is determ<strong>in</strong>ed by the capability of the compressor stations to<br />

deliver high pressure flows <strong>in</strong>to the pipel<strong>in</strong>es. This current limit is 1.24 million cubic metres per hour. Accord<strong>in</strong>g to<br />

the latest forecasts from <strong>Gas</strong> Networks <strong>Ireland</strong> (GNI) annual report, <strong>Ireland</strong>’s transmission network <strong>in</strong>frastructure has<br />

sufficient capacity to transport the anticipated gas demand to all end consumers <strong>in</strong>to the near future.<br />

2 <strong>Electricity</strong> and <strong>Gas</strong> <strong>Prices</strong> <strong>in</strong> <strong>Ireland</strong><br />

The current set of revenue controls for the gas transmission and distribution networks (CER/12/196) was published<br />

on 23 November 2012 and runs until September 2017. Dur<strong>in</strong>g the period yearly updates will be completed. The<br />

overall weighted distribution tariffs decreased <strong>in</strong> nom<strong>in</strong>al terms by 4.7% for the period 1 October 2014 – 30<br />

September 2015.<br />

For the transmission system, the CER directed (CER/14/140) <strong>Gas</strong>l<strong>in</strong>k to implement the follow<strong>in</strong>g tariffs from 1 October<br />

2014 to 30 September 2015 and noted that the average transmission tariff for UK gas will fall by 5.5%.<br />

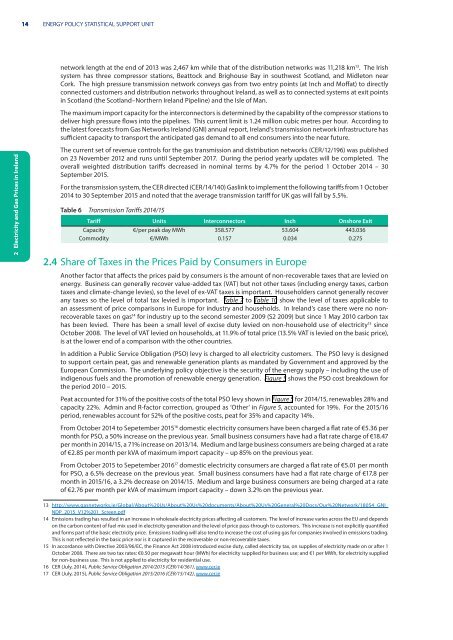

Table 6 Transmission Tariffs 2014/15<br />

Tariff Units Interconnectors Inch Onshore Exit<br />

Capacity €/per peak day MWh 358.577 53.604 443.036<br />

Commodity €/MWh 0.157 0.034 0.275<br />

2.4 Share of Taxes <strong>in</strong> the <strong>Prices</strong> Paid by Consumers <strong>in</strong> Europe<br />

Another factor that affects the prices paid by consumers is the amount of non-recoverable taxes that are levied on<br />

energy. Bus<strong>in</strong>ess can generally recover value-added tax (VAT) but not other taxes (<strong>in</strong>clud<strong>in</strong>g energy taxes, carbon<br />

taxes and climate-change levies), so the level of ex-VAT taxes is important. Householders cannot generally recover<br />

any taxes so the level of total tax levied is important. Table 7 to Table 10 show the level of taxes applicable to<br />

an assessment of price comparisons <strong>in</strong> Europe for <strong>in</strong>dustry and households. In <strong>Ireland</strong>’s case there were no nonrecoverable<br />

taxes on gas 14 for <strong>in</strong>dustry up to the second semester 2009 (S2 2009) but s<strong>in</strong>ce 1 May 2010 carbon tax<br />

has been levied. There has been a small level of excise duty levied on non-household use of electricity 15 s<strong>in</strong>ce<br />

October 2008. The level of VAT levied on households, at 11.9% of total price (13.5% VAT is levied on the basic price),<br />

is at the lower end of a comparison with the other countries.<br />

In addition a Public Service Obligation (PSO) levy is charged to all electricity customers. The PSO levy is designed<br />

to support certa<strong>in</strong> peat, gas and renewable generation plants as mandated by Government and approved by the<br />

European Commission. The underly<strong>in</strong>g policy objective is the security of the energy supply – <strong>in</strong>clud<strong>in</strong>g the use of<br />

<strong>in</strong>digenous fuels and the promotion of renewable energy generation. Figure 5 shows the PSO cost breakdown for<br />

the period 2010 – 2015.<br />

Peat accounted for 31% of the positive costs of the total PSO levy shown <strong>in</strong> Figure 5 for 2014/15, renewables 28% and<br />

capacity 22%. Adm<strong>in</strong> and R-factor correction, grouped as ‘Other’ <strong>in</strong> Figure 5, accounted for 19%. For the 2015/16<br />

period, renewables account for 52% of the positive costs, peat for 35% and capacity 14%.<br />

From October 2014 to Sepetember 2015 16 domestic electricity consumers have been charged a flat rate of €5.36 per<br />

month for PSO, a 50% <strong>in</strong>crease on the previous year. Small bus<strong>in</strong>ess consumers have had a flat rate charge of €18.47<br />

per month <strong>in</strong> 2014/15, a 71% <strong>in</strong>crease on 2013/14. Medium and large bus<strong>in</strong>ess consumers are be<strong>in</strong>g charged at a rate<br />

of €2.85 per month per kVA of maximum import capacity – up 85% on the previous year.<br />

From October 2015 to Sepetember 2016 17 domestic electricity consumers are charged a flat rate of €5.01 per month<br />

for PSO, a 6.5% decrease on the previous year. Small bus<strong>in</strong>ess consumers have had a flat rate charge of €17.8 per<br />

month <strong>in</strong> 2015/16, a 3.2% decrease on 2014/15. Medium and large bus<strong>in</strong>ess consumers are be<strong>in</strong>g charged at a rate<br />

of €2.76 per month per kVA of maximum import capacity – down 3.2% on the previous year.<br />

13 http://www.gasnetworks.ie/Global/About%20Us/About%20Us%20documents/About%20Us%20General%20Docs/Our%20Network/18054_GNI_<br />

NDP_2015_V12%201_Screen.pdf<br />

14 Emissions trad<strong>in</strong>g has resulted <strong>in</strong> an <strong>in</strong>crease <strong>in</strong> wholesale electricity prices affect<strong>in</strong>g all customers. The level of <strong>in</strong>crease varies across the EU and depends<br />

on the carbon content of fuel mix used <strong>in</strong> electricity generation and the level of price pass-through to customers. This <strong>in</strong>crease is not explicitly quantified<br />

and forms part of the basic electricity price. Emissions trad<strong>in</strong>g will also tend to <strong>in</strong>crease the cost of us<strong>in</strong>g gas for companies <strong>in</strong>volved <strong>in</strong> emissions trad<strong>in</strong>g.<br />

This is not reflected <strong>in</strong> the basic price nor is it captured <strong>in</strong> the recoverable or non-recoverable taxes.<br />

15 In accordance with Directive 2003/96/EC, the F<strong>in</strong>ance Act 2008 <strong>in</strong>troduced excise duty, called electricity tax, on supplies of electricity made on or after 1<br />

October 2008. There are two tax rates: €0.50 per megawatt hour (MWh) for electricity supplied for bus<strong>in</strong>ess use; and €1 per MWh, for electricity supplied<br />

for non-bus<strong>in</strong>ess use. This is not applied to electricity for residential use.<br />

16 CER (July, 2014), Public Service Obligation 2014/2015 (CER/14/361), www.cer.ie<br />

17 CER (July, 2015), Public Service Obligation 2015/2016 (CER/15/142), www.cer.ie